Home sales typically cool off by October following the busy summer homebuying months. This year is a little different as sales in both September and October came in higher than they did during the summer. With the sales momentum extending into early fall, November total home sales took an expected seasonal downturn. Housing inventory is on the rise as homes take longer to sell. This more than offsets a decline in new listings (a decline that reflects a more cautious stance among prospective sellers amid higher mortgage rates). Home prices, in the meantime, have remained relatively the same. Interest rates increased for the first time since spring 2024, defying the Federal Reserve’s second interest rate cut on Nov. 7. New single-family construction slowed down in November. Smaller markets outside the “Big Four” metros led the declines in privately-owned housing units authorized by building permits.

Sales Decrease, New Listings Follow

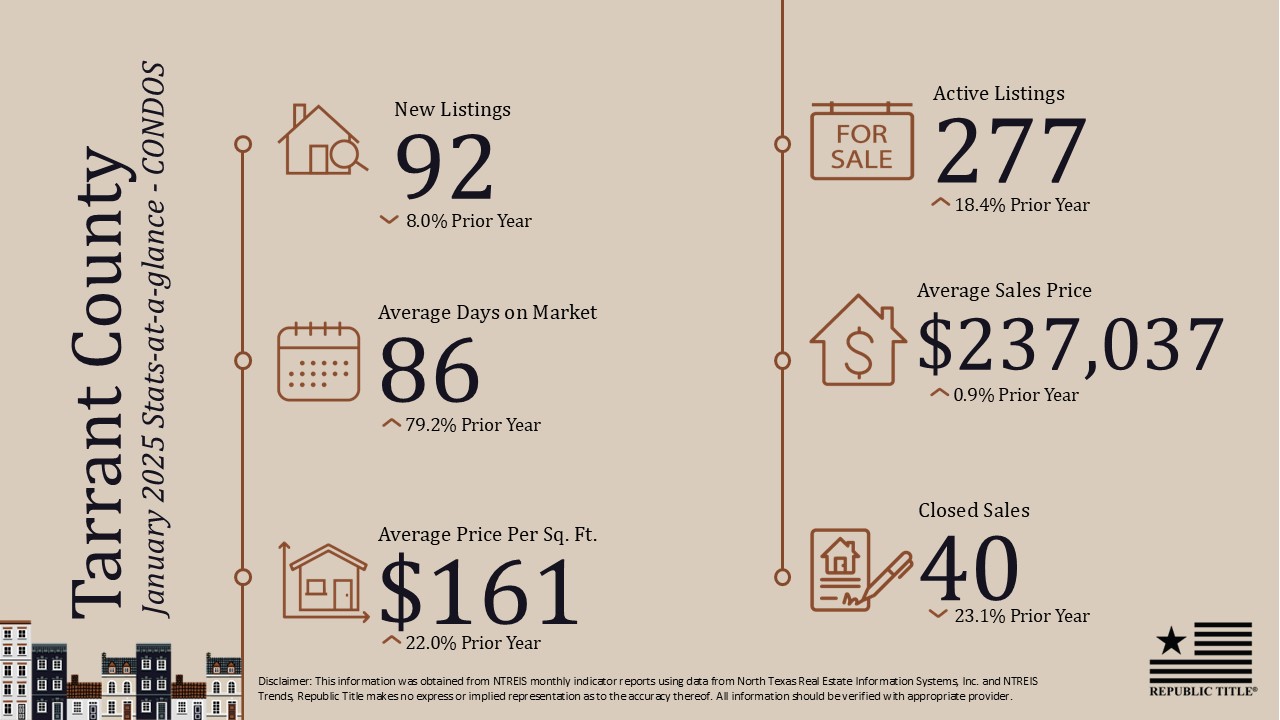

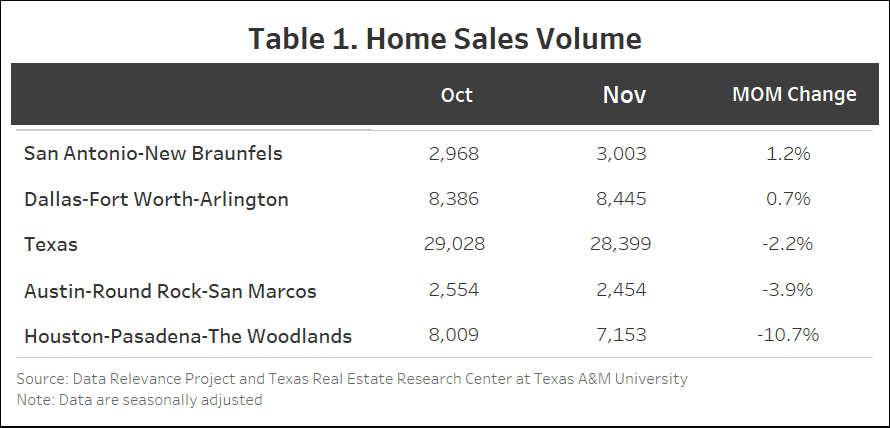

November home sales came in 2.2 percent lower than the previous month at a total of 28,399 transactions, driven largely by a seasonal contraction in the Houston market, where sales dropped 10.7 percent to 7,153. Austin followed with a 3.9 percent decline to 2,454 total sales. Sales were up 1.2 percent in San Antonio, totaling 3,003 transactions, while sales in Dallas remained relatively stable, edging up by 0.7 percent to 8,445 transactions.

November’s new listings saw a notable decline, reflecting a more cautious stance among prospective sellers amid higher mortgage rates and a seasonal market slowdown. Among the Big Four, Dallas had the most significant month-over-month (MoM) drop, down 8 percent to 11,353 active listing at the end of November. Houston followed with a 3.5 percent decrease (14,022), while San Antonio and Austin recorded more moderate declines of 1.3 percent (4,338) and 1.2 percent (3,742), respectively. The overall contraction in new listings may indicate sellers are adjusting expectations in response to mortgage rates defying the Fed’s interest rate cuts. Following the Fed’s second interest rate cut in November, mortgages rates moved in the opposite direction.

Statewide average days on market (DOM) edged up by one day to 62 days in November. In Austin, DOM was up from 73 to 75 days. DOM was up by one day in Houston (52) and Dallas (57). San Antonio was the only major metro to see a decrease in DOM, improving from 74 to 73 days, a reflection of increased buyer activity and more competitive pricing in the region.

Statewide housing inventory was up in November. Total active listings increased by 1.1 percent to an inventory of 124,195 by the end of the month. Among the Big Four, San Antonio and Houston saw inventory rising by 2 percent and 1.8 percent to a month-end inventory of 13,939 and 30,553, respectively. Dallas’ housing inventory remained relatively stable, edging up by just 0.2 percent. In Austin, active listings declined 0.8 percent from the previous month to 10,501 by the end of November.

Statewide pending listings increased in November by 2.2 percent, rising from 28,340 to 28,971. Across the Big Four, pending listings exhibited mixed trends, reflecting varying levels of buyer activity. Austin led with a 7.9 percent increase, rising from 2,644 to 2,852, suggesting a rebound in buyer interest despite broader market conditions. Houston saw pending listings up 6 percent for a total of 7,770. Pending listings declined in Dallas, down 4.6 percent from 8,491 to 8,101. San Antonio saw a more moderate decline of 2.1 percent, with pending listings decreasing from 3,095 to 3,029.

Interest Rates Up Again

In November, both Treasury yields and mortgage rates experienced notable increases, defying the Fed’s second interest rate cut on Nov. 7. The average yield on the 10-year U.S. Treasury Bond rose by 26 basis points (bps) to 4.36 percent, reflecting heightened capital market expectations of inflationary pressures building up in the economy. Similarly, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate mortgage climbed 38 bps to 6.81 percent.

New-Home Starts Decline

Statewide building permits declined by 10.5 percent from October to November. The declines were led by smaller markets, where November’s privately-owned housing units authorized by building permits were 37.8 percent below October’s. In the Big Four metros, the declines were more moderate: Dallas (9.7 percent), Austin (7.1 percent), Houston (6.7 percent), and San Antonio (5.1 percent).

Seasonally adjusted statewide single-family housing starts decreased by 8.9 percent since October to 13,037 units. All Big Four metros had a downturn. San Antonio and Dallas had the sharpest decrease at 18.9 percent (941) and 13.4 percent (3,289), respectively. Houston was down by 9 percent (3,925), while Austin fell 7.4 percent (1,445).

The total value of single-family housing starts climbed from $27.73 billion in November 2023 to $34.51 billion in November 2024. At $12.14 billion, Houston accounted for 35.2 percent of the state’s total starts value. Dallas followed with $9.39 billion (27.2 percent).

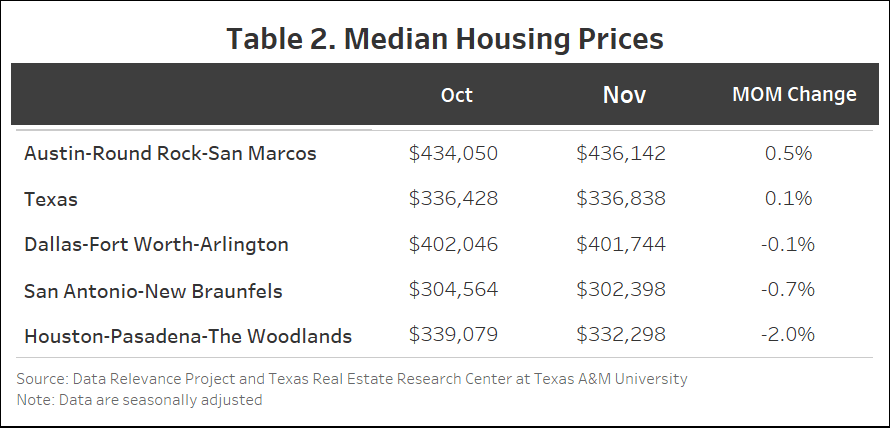

Home Prices Remain Steady

Texas’ median home price remained relatively stable in November, inching down by 0.1 percent from $336,428 in October to $336,838. Among the Big Four, Houston had the most significant decline, with prices falling 2 percent from $339,079 to $332,298. San Antonio followed with a 0.7 percent decrease, from $304,564 to $302,398. Dallas only saw a marginal 0.1 percent decrease from $402,046 to $401,744, indicating relative price stability. Austin recorded the highest price appreciation, rising 0.5 percent MoM to $436,142 amid strong pending listing activities.

The Texas Repeat Sales Home Price Index (Jan 2005=100), which is a more accurate reflection of home price changes, fell 0.4 percent MoM in November but was up by 2 percent year over year (YoY). Austin’s annual appreciation remains below the state’s average and fell by 0.8 percent YoY in November.

*All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month-over-month, unless stated otherwise.

Source: Texas Housing Insight | Texas Real Estate Research Center (By Yanling Mayer, Joshua Roberson, and Junqing Wu – February 24, 2025)