Total Texas housing sales increased 2 percent in May but continued to normalize from elevated levels the last few months of 2020. Single-family housing permits rose for the third consecutive month, although housing starts stumbled as lumber prices skyrocketed. Overall, sales were persistent despite rising costs and limited supply for homes priced less than $300,000, pushing sales activity toward higher-priced homes. Mortgage rates inched down after rising during the first quarter, but double-digit home-price appreciation chipped away at housing affordability. The unprecedented low level of inventory available for sale is the greatest challenge to Texas’ housing market. The state’s diverse and expanding economy, favorable business policies, and steady population growth, however, supported a favorable outlook.

Supply*

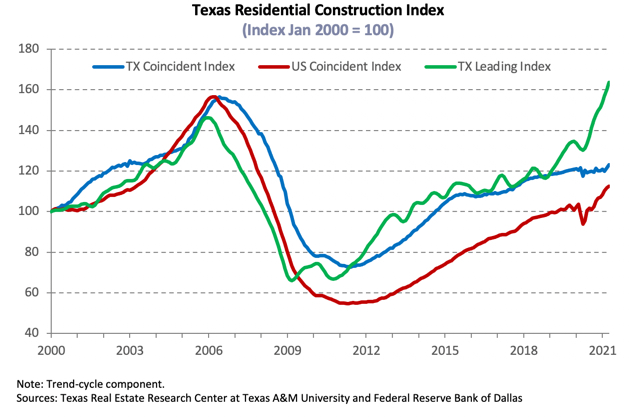

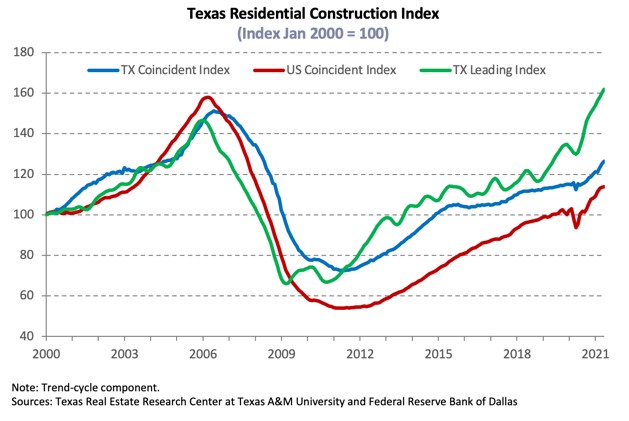

The Residential Construction Cycle (Coincident) Index, which measures current construction levels, elevated nationally and within Texas due to improved industry wages, employment, and construction values during May. The Texas Residential Construction Leading Index, however, decelerated as building permits (weighted by market value) and residential starts decreased, and the ten-year real Treasury bill increased. Still, the overall upward trend indicated stable future activity. Houston and Austin reflected statewide fluctuations in weighted building permits and residential starts. Houston’s leading index declined, while Austin’s metric remained on an upward trajectory. The Dallas-Fort Worth (DFW) and San Antonio indexes also suggested steady construction in the coming months.

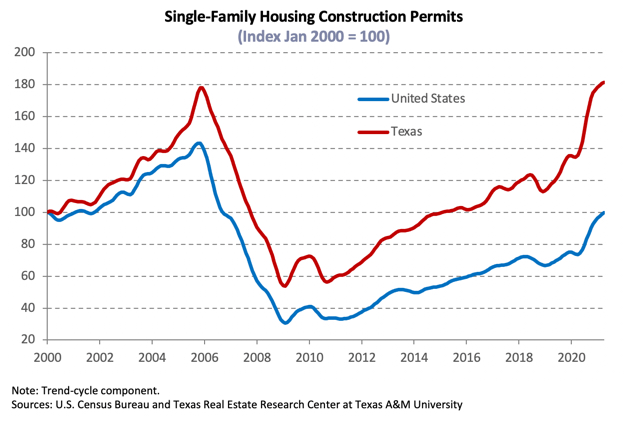

Single-family construction permits maintained steady growth of 4.8 percent in May, trending upward for more than a year. Houston topped the national list with 4,909 nonseasonally adjusted permits despite registering a seasonally adjusted decrease. DFW posted double-digit monthly growth to 4,880 permits. Meanwhile, Austin and San Antonio issued 2,283 and 1,383 permits, respectively. Texas’ multifamily sector registered a steep contraction as issuance shifted from five-or-more units to duplexes, triplexes, and four-unit structures. The metric, however, remained up 6.1 percent year to date (YTD) relative to the same period last year.

Despite strengthening economic conditions and ample housing demand, total Texas housing starts decreased 6.1 percent per capita as lumber prices skyrocketed 60 percent on a monthly basis to a record high. Similarly, single-family private construction values declined 8.7 percent in real terms as the metric trended downward in Texas’ major metros. San Antonio registered a steep plummet in values during May but was still the exception as values extended a yearlong upward trajectory due to strong growth at the beginning of the year.

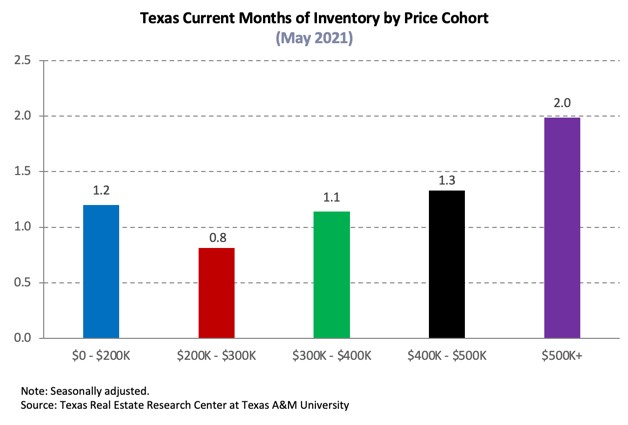

Texas’ months of inventory (MOI) sank below 1.2 months for the first time in series history as sales activity picked up and the number of homes added to the Multiple Listings Service decreased. A total MOI around six months is considered a balanced housing market. Inventory for homes priced less than $300,000 was even more constrained, dropping below 0.9 months. Even the MOI for luxury homes (homes priced more than $500,000), the price range at which inventory was least constrained, slid to two months.

Inventory in the major metros also declined during May. The supply situation in Austin was most critical with the MOI slipping to just 0.4 months. The metric in North Texas decreased to 0.9 and 1.0 months in Fort Worth and Dallas, respectively, while San Antonio inventory matched the statewide average. Houston’s MOI, although slightly greater than the other metros, ticked down to a record-low 1.4 months. The severe lack of inventory is unsustainable and is the main headwind to the health of Texas’ housing market.

Demand

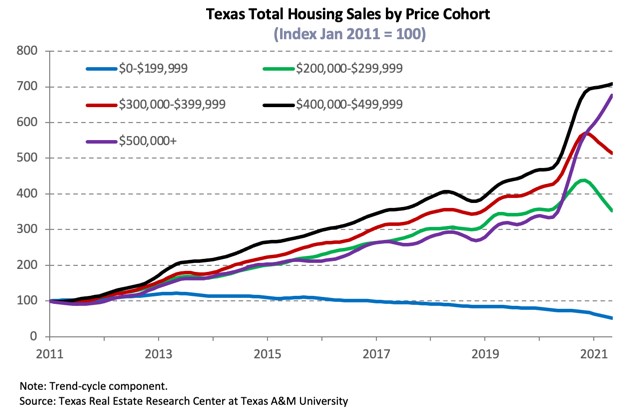

Total housing sales increased 2 percent in May as mortgage rates inched down, stabilizing at its yearlong average. Most of the slowdown is attributed to declining activity for homes priced less than $300,000 due to dwindling inventories. On the other hand, the number of sales for homes priced more than $400,000 improved for the third straight month.

Housing sales also rose on the metropolitan level but extended a downward trend from peak activity a few months earlier. Similar fluctuations across the price spectrum resulted in total sales growth of 2.3 percent in both Austin and Dallas. In San Antonio and Houston, the metric elevated 1.9 and 1.8 percent, respectively. Fort Worth sales, however, flattened amid a severe drop in activity for homes priced less than $250,000. Moreover, the metric dropped 16 percent YTD compared with the statewide contraction of 7.1 percent.

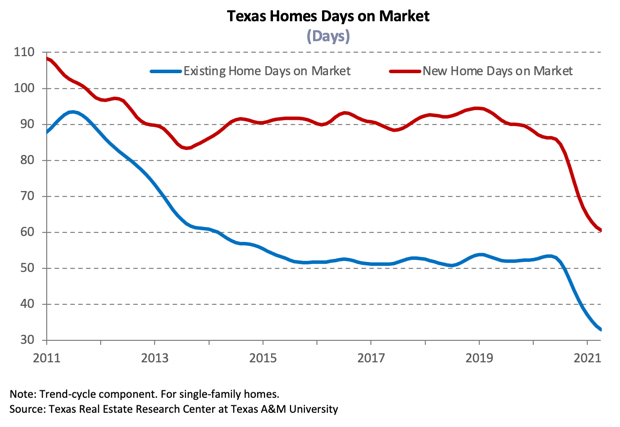

Texas’ average days on market (DOM) fell to a record-breaking 34 days, confirming that demand for housing is still robust, and the YTD decrease in sales is more due to restricted inventory. Austin’s DOM shed more than five weeks off its year-ago reading, plummeting to 18 days, while the average home in North Texas sold after just 25 days in Fort Worth and 26 days in Dallas. San Antonio’s and Houston’s metrics also registered steep declines but hovered closer to the statewide average, falling to 35 and 36 days, respectively.

Amid low expectations of additional fiscal and monetary stimulus, economic growth forecasts for the rest of the year cooled as the initial and strongest stage of recovery likely reached its peak, and inflation pressures are believed to be temporary. The ten-year U.S. Treasury bond yield stabilized at pre-pandemic levels of 1.6 percent** for the third consecutive month, while the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate ticked down to 3.0 percent. The median mortgage rate within Texas increased in April*** to 3.0 and 3.2 percent for GSE and non-GSE loans, respectively, but, similar to the national headline metric, remained below year-ago levels. After mortgage rate hikes, Texas home-purchase applications declined for the second consecutive month in May, falling 22.1 percent YTD. Refinance applications improved on a monthly basis but were still down 28.8 percent over the same period. Lenders adding more requisites and the shrinking pool of households able to refinance is likely impacting refinance activity as well. (For more information, see Finding a Representative Interest Rate for the Typical Texas Mortgagee.)

In April, the median loan-to-value ratio (LTV) constituting the “typical” Texas conventional-loan mortgage dropped from 87.6 a year ago to 83.8. The debt-to-income ratio (DTI) declined from 36.9 to 34.4, while the median credit score jumped 18 points in the last year to 757. The LTV and DTI for GSE borrowers also decreased from 86.5 and 35.9 last April to 85.7 and 35.3, respectively. Overall improved credit profiles reflect the fact that only the most qualified housing applicants are able to outbid their competition for their desired homes amid exceptionally tight inventories and robust demand.

Prices

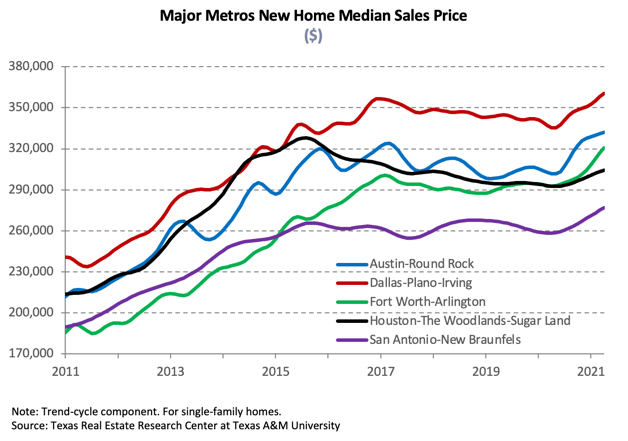

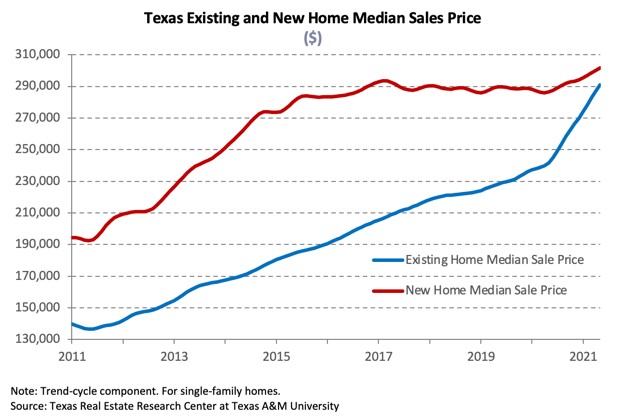

The ongoing shift in the composition of sales toward higher-priced homes due to constrained inventories at the lower end of the market supported home-price appreciation. The Texas median home price rose for the fifth consecutive month, accelerating 21.6 percent YOY to a record-breaking $292,100 in May. The share of luxury homes sold in Austin more than doubled to two-fifths compared with this time last year, contributing to the 42.1 percent YOY surge in the median price ($447,200). The Dallas metric ($361,900) increased 25.8 percent while annual price growth in Fort Worth ($298,300) shot up to 24.0 percent in May from 14.4 percent the previous month. Houston’s ($291,700) and San Antonio’s ($271,900) metrics elevated 20.6 and 16.1 percent, respectively.

The Texas Repeat Sales Home Price Index accounts for compositional price effects and provides a better measure of changes in single-family home values. Texas’ index corroborated substantial and unsustainable home-price appreciation, soaring 14.8 percent YOY. The metric skyrocketed 38.4 percent in Austin, followed by North Texas with 18.2 and 16.2 percent home-price appreciation in Dallas and Fort Worth, respectively. San Antonio posted a 15.4 percent annual hike, while Houston’s index registered double-digit growth for the first time since the series started in 2014, elevating 11.4 percent. Increasing home prices pressure housing affordability, particularly in an environment of low wage growth.

Single-Family Forecast

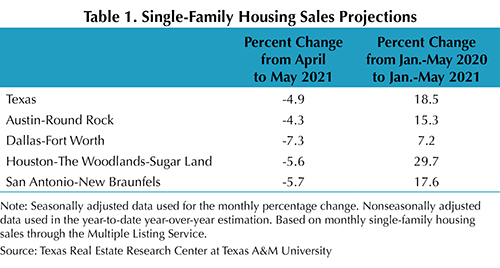

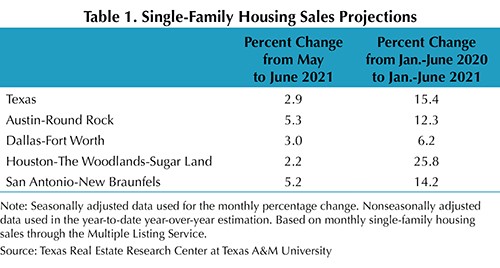

The Texas Real Estate Research Center projected single-family housing sales using monthly pending listings from the preceding period (Table 1). Only one month in advance was projected due to the uncertainty surrounding the COVID-19 pandemic and the availability of reliable and timely data. Texas sales are expected to recover 2.9 percent in June after two consecutive monthly declines. The metric is estimated to rebound 5.3 and 5.2 percent in Austin and San Antonio, respectively, with more moderate increases of 3.0 percent in DFW and 2.2 percent in Houston. Sales through the first half of 2021 should surpass activity during 1H2020, but the rate of growth has decelerated. On the supply side, inventory should improve slightly, possibly reaching a trough, with the forecast predicting a rise in both active and new listings. Constrained inventory has curbed sales during the past few months.

Household Pulse Survey

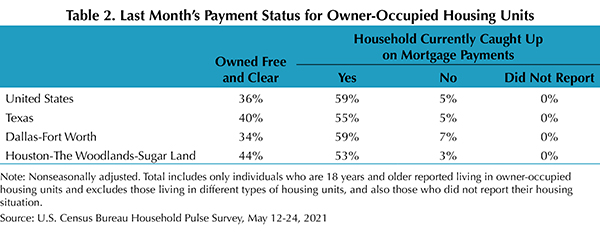

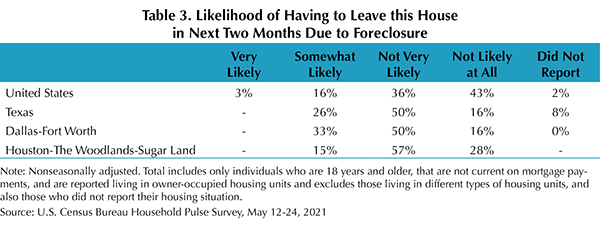

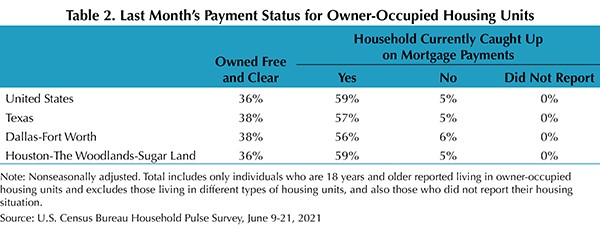

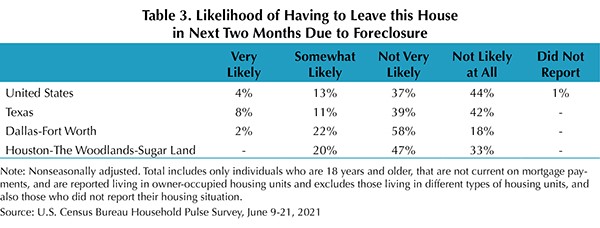

According to the U.S. Census Bureau’s Household Pulse Survey, the share of homeowners behind on their mortgage payments flattened at 5 percent nationally and within Texas (Table 2). Houston reflected the statewide average, while the metric in DFW hovered higher at 6 percent. The share of Texas respondents who were not current and expected foreclosure to be either very likely or somewhat likely in the next two months ticked down from 26 percent in April to 19 percent (Table 3). The proportion of delinquent individuals who were at risk of foreclosure also declined in North Texas, falling from 33 to 24 percent but increased five percentage points to 20 percent in Houston. Both the Federal Housing Finance Agency’s foreclosure and REO eviction moratoria for properties owned by Fannie Mae and Freddie Mac and the Centers for Disease Control and Prevention’s federal eviction moratorium were recently extended through July 31, 2021. The latter is not expected to be renewed again. Continued stability in the housing market is essential to Texas’ economic recovery.

________________

* All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.

** Bond and mortgage interest rates are nonseasonally adjusted. Loan-to-value ratios, debt-to-income ratios, and the credit score component are also nonseasonally adjusted.

*** The release of Texas mortgage rate data typically lag the Texas Housing Insight by one month.

To see the previous month’s report, click here. For the report from a year ago, click here.

Previous reports available:

2021: January, February, March, April , May, June

2020: January, February, March, April, May, June, July, August, September, October, November, December

2019: January, February, March, April, May, June, July, August, September, October, November, December

Source – James P. Gaines, Luis B. Torres, Wesley Miller, Paige Silva, and Griffin Carter (July 13, 2021)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight