Open Houses are a vital part of buying a home. For agents who have had to cancel all their open houses due to the current COVID-19 pandemic, this can impact your ability to sell properties. Thankfully, Facebook LIVE offers agents the opportunity to tour clients through a listing during a real-time, interactive broadcast – a Virtual Open House. The best part is that you don’t need any fancy equipment or a huge crew, just your smartphone and a Facebook page. In this post, we discuss everything you need to know about using Facebook live to tour your clients through a listing. Don’t let this COVID-19 pandemic prevent you from hosting an open house.

What is Facebook Live?

Facebook Live allows you to broadcast a conversation, performance, Q&A or virtual event. You can go live on a Page, in a group or an event, and your live videos will also appear in people’s New Feed. For more information on Facebook Live, visit: https://www.facebook.com/facebookmedia/solutions/facebook-live

How to Set Up Your Facebook Live Open House

Now that we’ve discussed what Facebook live is, it is now time to talk about how to set it up. Below are some practical steps/directions to make going LIVE easy.

How to Create an Event from Your Page:

- Go to your Business Profile Page (or your personal page-but remember FB rules-if your advertising you should be doing this on your FB Business page).

- Tape to “Create” a post and choose “Event” from the list.

- Add an event photo, perhaps the front of the house, then enter your event’s title, location, date, and time.

- Save the event, then post a link to your listing, and send to your clients!

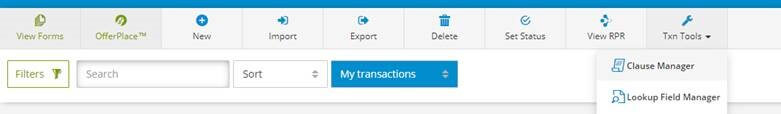

How to go LIVE from your Page:

- Go to your Business Profile Page (or your personal).

- Tap “Create a Post” and choose “LIVE” from the list.

- Make sure the app has access to your camera and microphone.

- Set permissions to “Public”.

- Add a description to the video – highlight the house information.

- Tap “Start Live Video” to being your Open House Live!

Useful Links:

Below are some useful links that explain how to go live on Facebook

How to Properly Advertise Your Facebook Live Open House

To ensure people show up, think about the strategies you use to generate awareness for your actual open house. People need to know when and where. That is why it is so important to properly advertise your open house. If you don’t properly advertise it, people won’t know about it and as a result won’t show up. Below are some things that you should do to advertise your Facebook live open house.

Use Facebook Events

You can use Facebook Events to get your Open House on their calendar, send updates and reminders. You can create an event on Facebook by navigating to your News Feed, clicking on Events and then Create Event.

Send Out Email Blasts

Send an email blast to your network letting them know when to tune in to your Facebook Page for the LIVE; include a link to your Facebook Page. Post those same details on your website, and your listings. There are many email marketing programs online that you can use including Constant Contact, Mail Chimp, and iContact.

Use Direct Outreach

Directly reach out to potential buyers from your cancelled Open House and invite them – this will make them feel like a VIP. Maybe you already advertised this Open House prior to the shutdown or have advertised it via Social Media. Contact those leads and invite them to your virtual open house. You could also personally invite all the neighbors in a 10-20 house radius.

How to Host an Open House Using Facebook Live

Your first time broadcasting live can be a little intimidating, but if you do some pre work, things can run rather smoothly. Your audience expects information and authenticity over production quality. Below are some tips on how to host an open house using Facebook live.

Prepare Beforehand

Plan your tour the same as you would with a live client. Where are you going first, what are you highlighting in each room? It never hurts to rehearse. Making a good first impression is important. Declutter the home, make sure it is clean, remove as much personal items as possible, etc.

Be Sure to Introduce Yourself

You should always begin your Facebook live open house by introducing yourself, sharing your credentials, and top lining what’s great about the home. Building trust with your audience is key to success. Introduce yourself with confidence and grow your personal brand. Potential buyers, on the other hand, get to know you before ever meeting. Agents are encouraged to show their personality on camera, be memorable, and most of all – be honest and bring value to the audience.

Remind People Who You are and What Property You’re Touring

Introducing yourself just once at the beginning of your Facebook live tour is not good enough. This is because people may come in and out while you’re LIVE. Therefore, it is critical that you periodically remind them who you are and what property you’re touring.

Interact with Your Audience

Interact with your audience; build in time for each room to pause and answer questions from the comments. If you know your audience well enough, you can engage them by spending extra time on the parts of the property that matter most. If they have pets, show them the ample yard and the fencing. If they are interested in the appliances, go in for a close-up of the high-end appliances, etc. Personalization is essential to success.

What to do After You Go Live on Facebook

After the LIVE stream is over, the video becomes on-demand content, which can then be shared, downloaded, edited, and re-purposed. It is highly likely that even more people will see your LIVE tour AFTER you’re finished. Here are some things to do after you go live on Facebook.

Send the Link of The Live Stream Your Clients

You can use links to the “Live After” video on your listings and send to clients who missed the tour. To help boost your viewership among people who didn’t join you for the live show, try sharing a quick post thanking people for watching.

You can also ask for new questions and comments to generate additional engagement. The people who view your videos like to feel appreciated, so show them some love wherever you can.

Save and Edit Your Video

Save your live video to edit. You can use a shorter clip to post on your page. Think of these as house highlights.The agent now has video content that can be shared on Instagram, YouTube, Facebook, or even email.

Read Comments from Your Audience

Use comments from the audience to gauge what type of information they are looking for about the property and tailor your future ad to these comments.

Follow Up with Prospects

Follow up with your prospects on Messenger, they may eventually be interested in putting in an offer. The fact is, your prospects are on Facebook already if they are commenting on your video while it’s live. After guests leave your virtual open house, use messenger to interact, engage and ask questions. Nurture those leads now even if they choose not to buy.

PRO Tips:

You don’t need a whole crew to have a decent production. Here are some tips to help you feel like a Pro:

- Test your connection throughout the house so you know if there will be any connectivity issues.

- Turn off notifications before you begin your broadcast!

- When you’re in rooms, consider placing the phone on a tripod for stability while you speak.

- As you are walking or panning through a room, go SLOWLY – slower than you think necessary, as fast jerky actions can be disorienting. Consider using a stabilizer.

- Have the listing information handy in case you get a question.

- Watch some other home tour videos – note what you like and what you think doesn’t work.