The state’s average days on market (DOM) enters its sixth month of decreases, falling from 59 days in February to 52 days in October, indicating a shorter listing period. Among the major metros, Houston (44 days) posted the only monthly decrease while San Antonio (70 days) posted the largest gain. Dallas (44 days) and Austin (68 days) remain unchanged from the previous month.

Housing supplies are stocking up as active listings marked their seventh straight month of increases, climbing 4.1 percent to 98,875 listings. All four major metros posted monthly gains with Houston (8.5 percent) adding 1,867 listings while Austin (0.9 percent) had a moderate gain of 84 listings. The constant increases since the start of 2023 have put the state’s active listings number at October 2019 levels.

The state’s new listings fell 1.45 percent to 42,100 in October. San Antonio contributed heavily to this decline, falling over 17 percent (790 homes). Amid the rise in active listings, the months of inventory (MOI) grew to 3.8 months with all four major metros posting marginal gains.

High Mortgage Rates Continue to Impair Affordability

The Fed’s effort to curb inflation has led to a substantial rise in both treasury and mortgage rates. The ten-year U.S. Treasury Bond yield grew for the sixth consecutive month reaching 4.8 percent. Likewise, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate increased to 7.62 percent, up 42 basis points. The inflated mortgage rate is expected to further raise the cost of homeownership, decreasing mortgage applications.

Single-Family Permit Levels Rebound

Texas’ single-family construction permits rose 1.1 percent month over month (MOM) to 12,619 issuances. All four major metros reported growing demand for permits except for Houston (4,007 units), falling 4.6 percent. Among the other three metros, both San Antonio (967 units) and Dallas (3,731 units) saw double-digit monthly percent gains at 31 and 24 percent, respectively. Austin rebounded from last month’s fall, climbing 8.7 percent to 1,643 units.

Construction starts grew alongside construction permits according to data from Dodge Construction Network. Single-family construction starts increased 1.2 percent MOM to 11,556 units. Both Dallas and Houston led with over 3,250 houses breaking ground, surpassing the combined total of other metros outside the Big Four. Home project starts in Austin (1,605 starts) and San Antonio (694 starts) surpassed the typical 2:1 ratio.

The state’s year-to-date total single-family starts value climbed to $25.4 billion, up from $22.8 billion in September. Starts values continued the previous month’s trend of mirroring the values observed in 2019. Houston and Dallas remain the largest contributors, accounting for more than half of the state’s construction activity values. Dallas’ market share rose to 30.2 percent, with Houston trailing at 29.7 percent.

Median Home Price Falls for First Time Since February

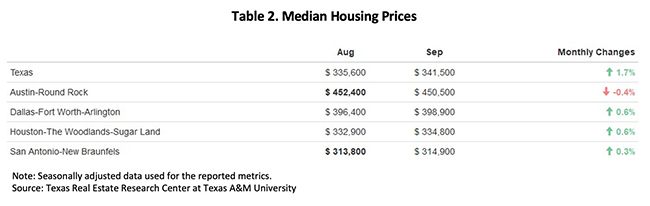

After last month’s spike in median home prices, October erased that increase with the housing market easing as the median home price fell 1.9 percent MOM, falling by over $6,000 from last month. Housing prices remained elevated, but this month they declined as all of the Big Four metros reported monthly decreases with Austin experiencing the greatest decrease at 3 percent. Dallas and Houston declined by over 1 percent while San Antonio declined the least at 0.7 percent (Table 2).