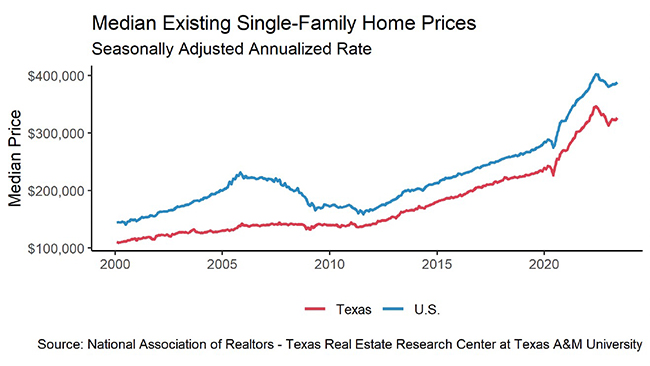

Contrary to investors’ fears, the “housing bubble” did not burst. Instead, a harmonious decline in both supply and demand has struck a balance, resulting in a boost to the housing median price. Throughout the first half of 2023, Texas’ median price has consistently shown a 0.3-0.4 percent growth every month. Due to current owners’ reluctance to sell their existing property, the demand for new construction has significantly increased. This preference shift led to a swift climb in the market share of new construction, which surpassed 20 percent in June.

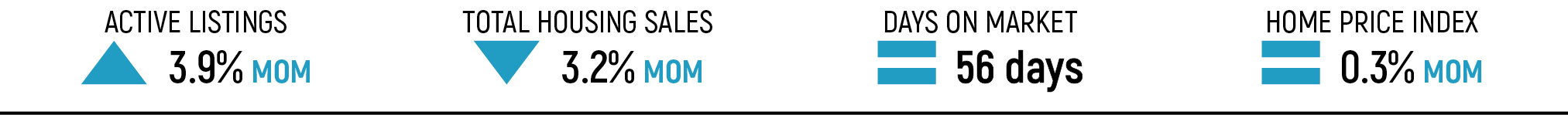

Active Listings Rebound for First Time in Eight Months

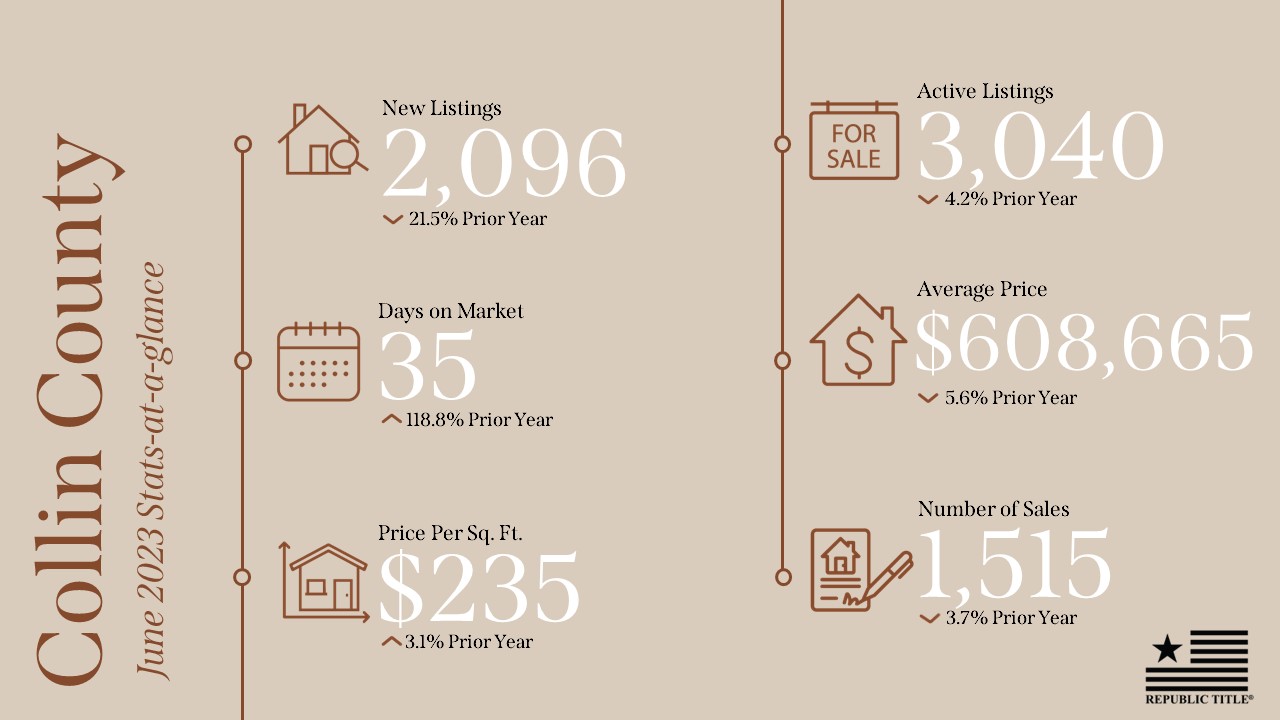

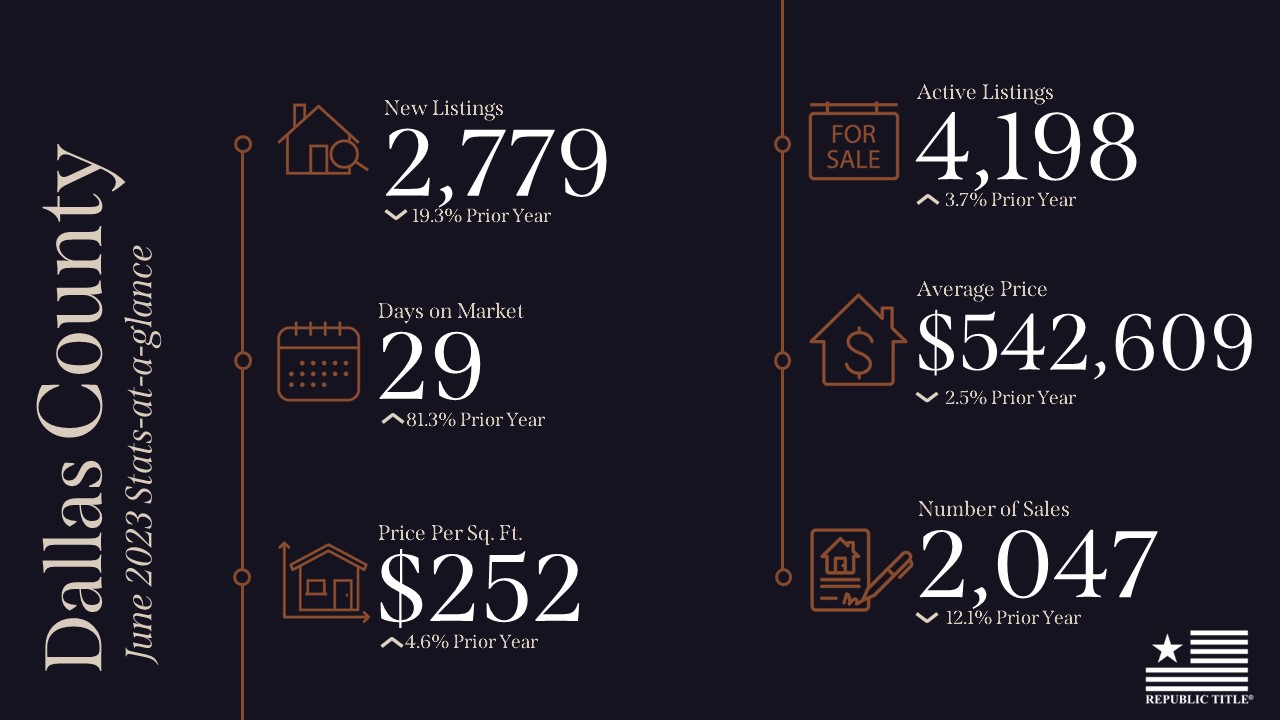

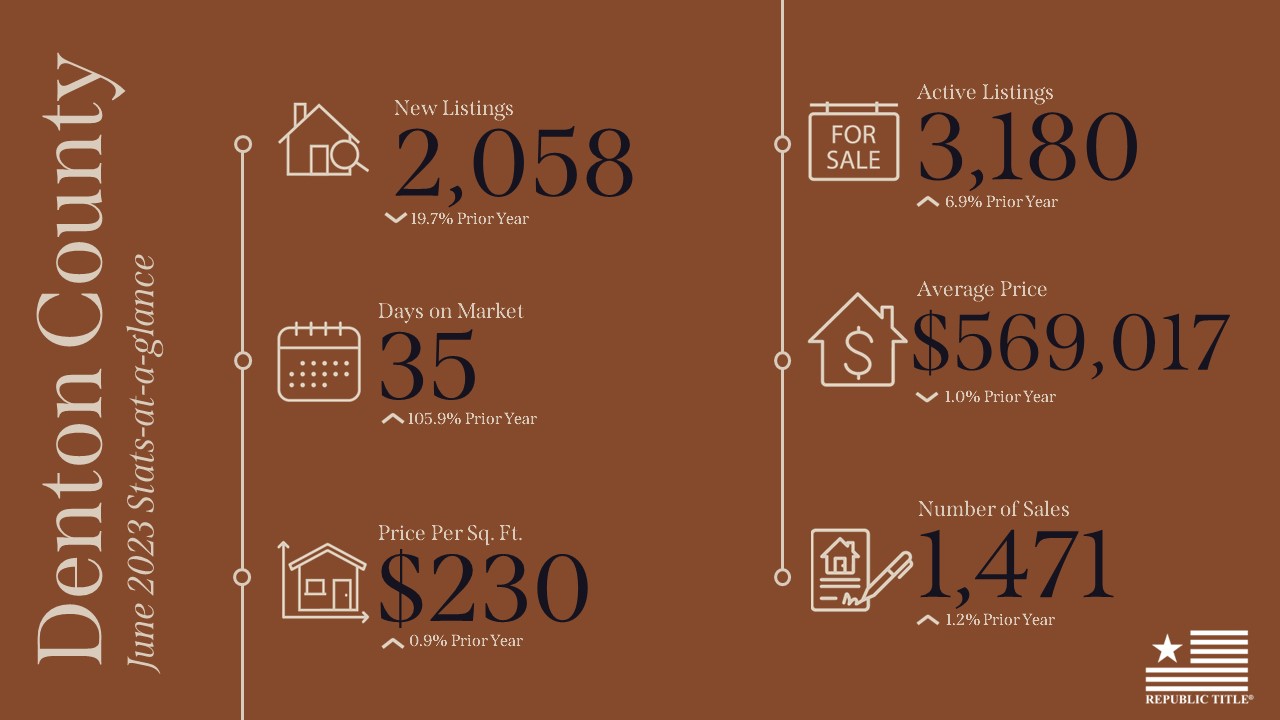

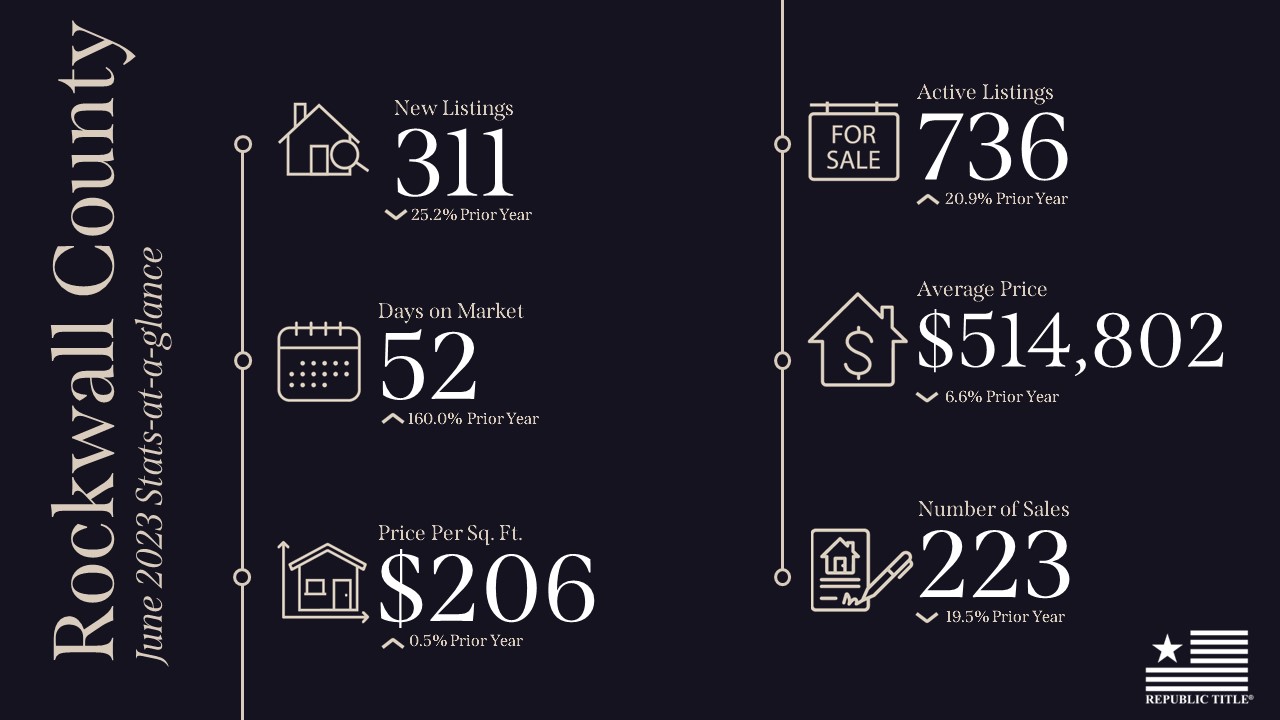

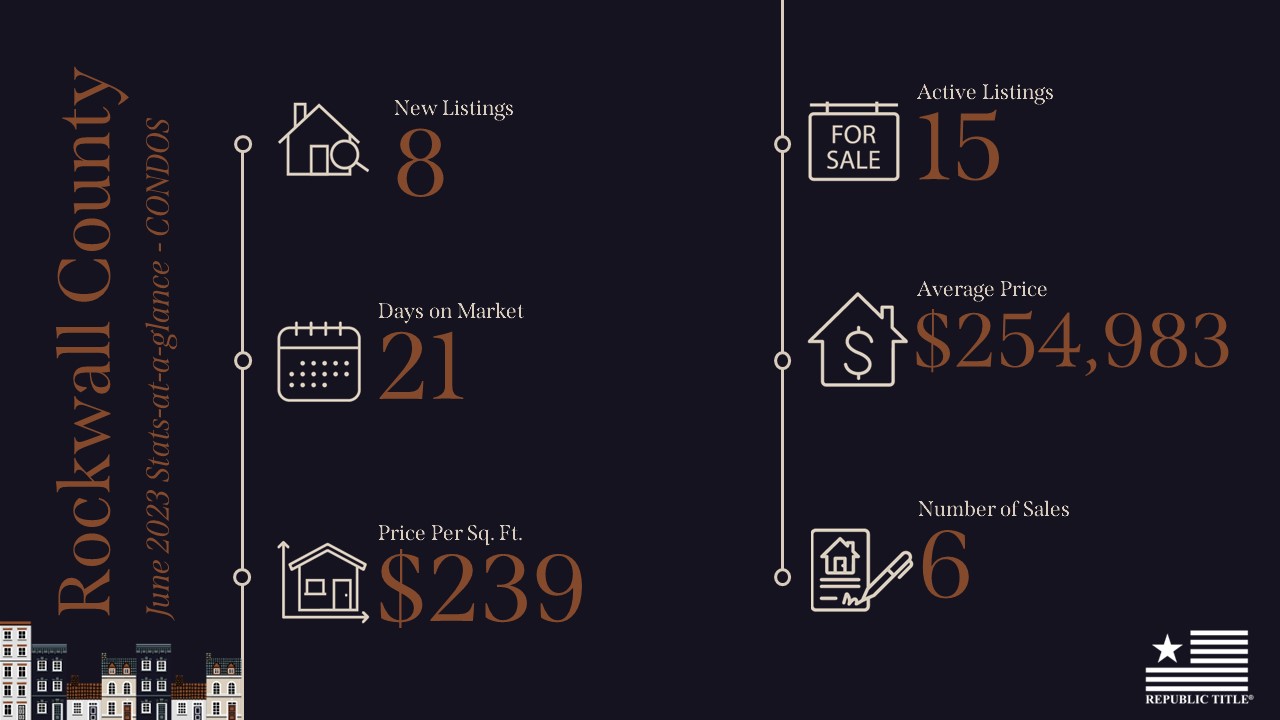

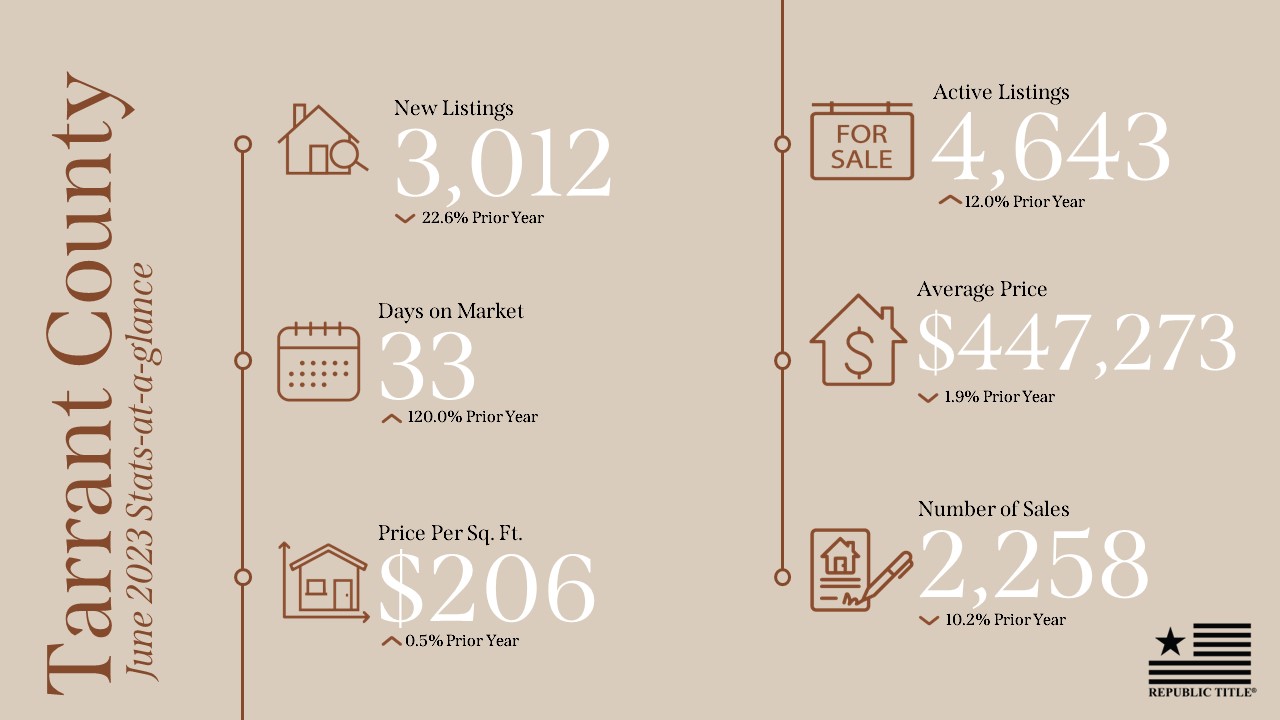

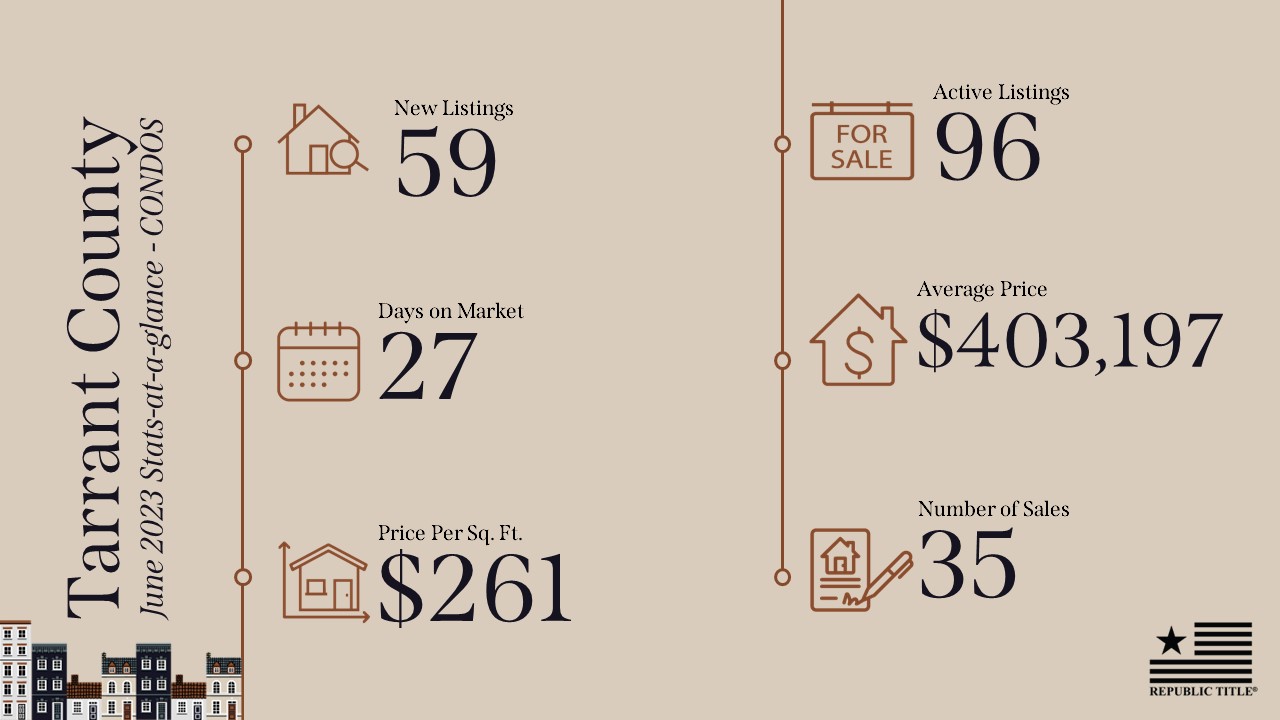

The number of active listings rose for the first time since November 2022, reaching 82,064 units after a 3.9 percent month-over-month (MOM) growth. However, none of the Big Four metros recorded a positive monthly gain. The boost of available homes primarily came from the smaller housing markets, such as El Paso, Killeen, Midland, and Texarkana. The number of new listings increased by 6.7 percent to 40,800 units, accounting for half of active listings. All major metros bucked the trend of acceleration with growth ranging from 3.3 percent to 8.9 percent. Correspondingly, months of inventory (MOI) had a marginal gain of 0.1 months.

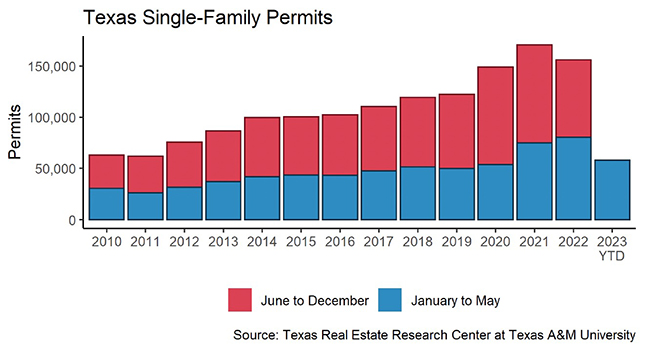

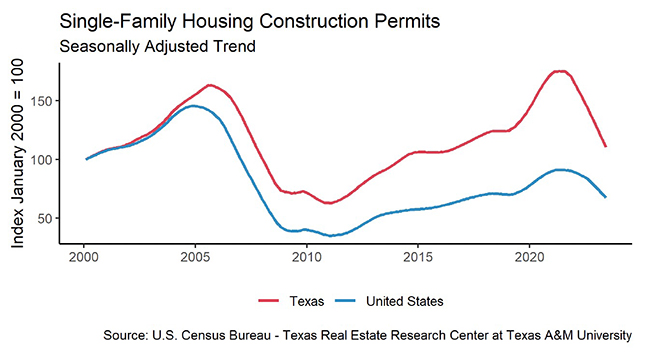

Regarding the upcoming inventories, Texas’ single-family construction permits had their second decline in three months, dropping by 2 percent in June. While the number of permit applications has significantly shrunk from the frenzy of applications during the pandemic, permit issuance seems to be returning to the ten-year trend before the pandemic.

At the metro level, Houston had the largest demand for permits with 4,500 issuances in June, maintaining the same level as in May. Dallas and Austin both had a mid-single-digit reduction, falling to 3,480 and 1,040 units, respectively. In contrast, San Antonio’s permit demand was rising this year, jumping from 500 units in January to 840 units in June. Permit demand remains significant in the Texas housing market.

Despite the fall in permits, single-family construction starts rose for the third consecutive month to 11,240 units. Both Dallas and Houston had more than 3,500 houses break ground, surpassing the combined total of other metros outside the “Big Four.” While the number of home projects in Austin (1,540 starts) outpaced San Antonio (804 starts), the gap has gradually narrowed as permit demand accelerated in San Antonio. The overall trend indicates a positive momentum in the Texas single-family construction market.

The state’s total single-family starts value reached $15.9 billion year-to-date (YTD), indicating a decline from $23.2 billion recorded in 2022. Houston and Dallas continue to account for more than half of the state’s construction activity values. Dallas’ share of the Texas market rose to 27.5 percent, coming close to Houston’s share of 28 percent.

Housing Market for New Construction Is Booming

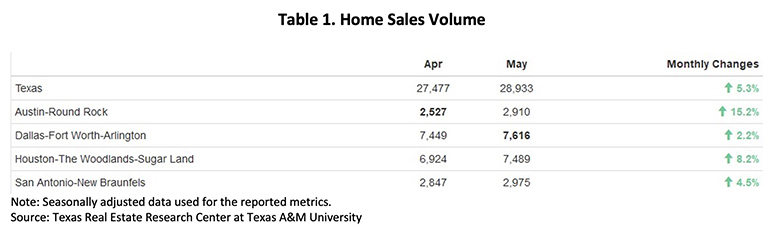

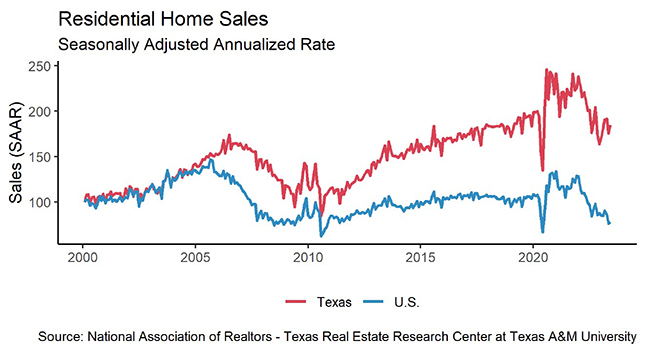

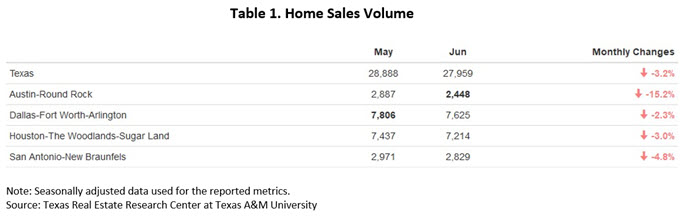

As mortgage rates remain elevated, homebuyer demand has decreased, leading to a drop in Texas’ total home sales, which fell below 28,000 transactions in June (Table 1). This represented a decline of 3.2 percent MOM and 11.8 percent year over year (YOY). Among the four major metros that reported fewer monthly sales, Austin declined the most with a double-digit reduction.

Despite the challenge of high mortgage rates and reduced housing demand, the market share of new construction sales surged. Within a year, the share of new construction sales rose from 16.3 percent to more than 20 percent, indicating every five closed listings is a new home. Both demand and supply factors contributed to the increasing trend for new homes. The shortage of existing homes is due to current owners’ reluctance to give up their current homes, while the state’s consistent home demand, fueled by a growing population, is spurring new construction orders.

Texas’ average days on market (DOM) stayed at 56 for the second straight month, deviating from the steep rebounding trend observed for over a year. The current reading is merely three days short of the five-year average before 2020, which stood at 59 days. The consistent reading suggests that the housing market may have reached a state of equilibrium. Among the major metros, Austin and San Antonio both reported a DOM of 71 days, while Dallas and Houston had DOM figures of 52 days and 49 days, respectively.

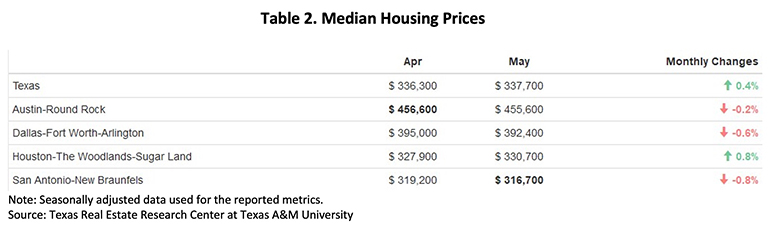

Steady and Modest Price Gains Amid Sales Volatility

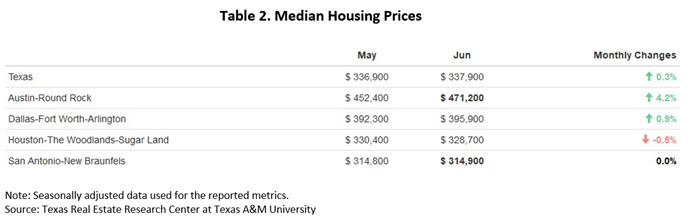

Texas’ median home prices continued to show its strength by increasing 0.3 percent to $337,900 (Table 2). Austin recorded the largest monthly gain of 4.2 percent, reaching a price peak in the past nine months. The remaining three metros recorded changes of less than 1 percent.

Despite Austin’s price hike in June, this metro was still close to 10 percent below last year’s record high, facing the largest price gap. Meanwhile, Dallas, Houston, and San Antonio had less than 5 percent to bridge. These price drops indicate the real estate industry still has room to recover from the price correction observed in the second half of 2022.

The Texas Repeat Sales Home Price Index, which accounts for compositional price effects and provides a better measure of change in single-family home values, showed a slight advance of 0.3 percent MOM and 0.1 percent YOY. Houston had the highest annual appreciation with 1.6 percent YOY increase, while Austin remained balanced with no YOY changes.

Mortgage rates typically follow Treasury rates, and both increased in June. The ten-year U.S. Treasury Bond yield grew 18 basis points, reaching 3.8 percent. Likewise, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate increased moderately to 6.7 percent, up 28 basis points. With the Fed resuming their increasing of interest rates in July, both the bond and the mortgage rates also grew.

____________________

* All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.

Source – Joshua Roberson, Weiling Yan, and Koby McMeans (August 15, 2023)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight