Republic Title is pleased to offer a variety of continuing education classes for our customers. Join us in March for classes including:

Creative Financing Pitfalls in a High Interest Rate Market

All licensees must be prepared to handle aspects of special types of financing. This class focuses on the specifics of alternative types of financing such as Seller Financing, Loan Assumption, and Lease to Own and discusses types of financing to avoid.

March 1st

2:00 pm – 3:00 pm

Republic Title North Coit

Tax Planning Program Specifically for Real Estate Agents

Join us for a Lunch and Learn with special guests from Greenlight Tax Group. They’ve designed a tax planning program specifically for REALTORS®. They will share strategies to help you minimize your tax liability and keep more of what you make year after year. Please register in advance, as seats are limited.

March 2nd

11:30 am – 12:30 pm

Republic Title Park Cities

Property Tax 100

Join us as Glenn Goodrich and Jim Goodrich, with PropertyTax.io answer questions about winning the property tax protests in 2021. How will COVID-19 affect the process? What are the deadlines? Which areas will see the largest increase? These questions and more will be addressed in this timely class.

March 7th

10:00 am – 11:00 am

Zoom

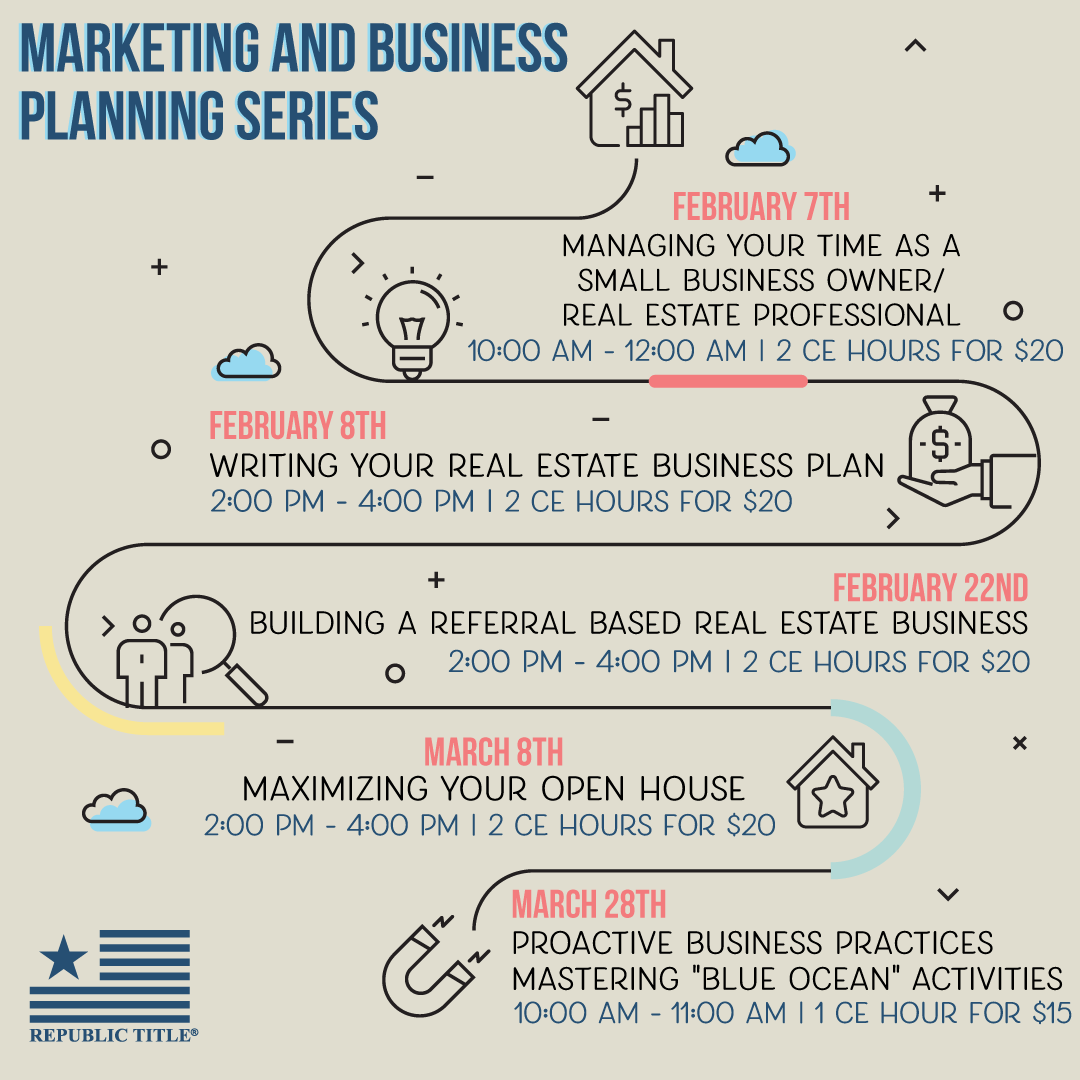

Maximizing Your Open House

Holding an open house is a great way to showcase a new listing and attract prospective clients. In this course, agents will learn how to maximize their open house opportunity and learn how to promote the property, generate leads and practice good safety while on the job.

March 8th

2:00 pm – 4:00 pm

Zoom

Tax Tips Every Real Estate Agent Needs to Know

This class will cover issues to help REALTORS® with their personal taxes, with removing Federal Tax Liens when closing sales, and with IRS problems they or their client may have. Some of the topics discussed in this one-hour class include: Tips on Keeping Records & Recommended Forms to File, Tax Deductions You Should be Taking, How to Make Estimated Taxes Work with your Cash Flow, Tax Areas of Special Interest to REALTORS®, and How to Use the Home Office Deduction.

March 14th

2:00 pm – 3:00 pm

Zoom

New Forms Editor-zipForm®

The new forms editor in zipForm® introduces several intelligent and intuitive features, giving agents and brokers everything they need to prepare and send forms faster than ever. With a new and improved workspace, you can autofill forms, fill out multiple forms at once, mark up documents, add personalized clauses and quickly add signers and property information.

March 22nd

10:00 am – 11:00 am

Zoom

TREC Legal Update I

Legal Update I covers various topics related to changes in regulations, forms, and standards of practice in the real estate industry including: TREC statute and rule updates, an overview of changes to and best practices for promulgated contract and addenda forms, and updated information on fair housing and property management laws and regulations.

March 23rd

9:30 am – 1:30 pm

Republic Title Uptown

Escape Hatches for Buyers

In this class licensees will become familiar with specific conditions & contingencies within the contract and related addenda that, if not adhered to, could result in a Buyer’s valid termination of the contract.

APPROVED TREC CONTRACT-RELATED COURSE

March 23rd

10:00 am – 11:00 am

Caddo Office Reimagined McKinney

Escape Hatches for Buyers

In this class licensees will become familiar with specific conditions & contingencies within the contract and related addenda that, if not adhered to, could result in a Buyer’s valid termination of the contract.

APPROVED TREC CONTRACT-RELATED COURSE

March 23rd

11:00 am – 12:00 pm

Republic Title Preston Frankford

Proactive Business Practices I Mastering “Blue Ocean” Activities

Most Small Business Owners (SBO)/ Real Estate Professionals utilize reactionary business practices. They are utilizing marketing techniques and practices that were unique and forward thinking 6 months ago. They react to market shifts as they happen rather than implement business practices that will keep them ahead of economic shifts. The idea of “blue ocean” is to make sure you have positioned your marketing, your business practices and your business strategies with proactive tools vs. reactionary responses. Agents will evaluate their businesses and business styles. They will create a plan to implement and “catch wind” that will allow them to be seen, heard and felt in their communities. They will “sail into blue ocean” vs. “swimming in red seas”.

March 28th

10:00 am – 11:00 am

Zoom

TREC Legal Update II

Legal Update II covers a host of topics that TREC has deemed critical for all licensees to be familiar with, including fiduciary and ethical duties of the agent, guidance on dealing with water and mineral rights, and important updates to tax laws and rules.

March 28th

12:00 pm – 4:00 pm

Republic Title Uptown

Online Contracts via zipForm®

Join us to learn the basics of using Lone Wolf Transactions, zipForm® Edition (formerly zipForm® Plus). zipForm® enables real estate agents to quickly and efficiently create digital transaction files, complete and fill in contract details, attach documents and even get them electronically signed by buyers, sellers and other parties involved in a real estate transaction.

March 29th

10:00 am – 12:00 pm

Republic Title Southlake