With all the recent buzz on Buyer’s Agent representation and compensation, now more than ever is it important for you as a REALTOR® to clearly and effectively express your value to your clients and potential clients. If our decades of industry experience here at Republic Title have taught us anything, it’s the critical role REALTORS® play in ensuring smooth and successful transactions. With our list of 9 Benefits of Using a REALTOR® When Buying or Selling a Home, you can help relay the essential role you play to your clients in helping them navigate the real estate market and their transaction.

Click here for a downloadable printer-friendly version of our list of 9 Benefits of Using a REALTOR® When Buying or Selling a Home.

1. Real Estate is a Full-Time Job

Real estate transactions require a significant investment of time and effort, which can be challenging for individuals to manage independently. REALTORS® dedicate their full time to the real estate profession, handling various tasks that might overwhelm an average person. For sellers, this includes staging the home, taking professional photographs, creating listings, hosting open houses, and negotiating with buyers. For buyers, a REALTOR® spends time searching for properties that meet the client’s criteria, scheduling and attending viewings, providing detailed property analyses, and guiding them through the offer and closing process. By managing these tasks, REALTORS® ensure that no aspect of the transaction is overlooked, providing a seamless and efficient experience for their clients.

2. Expert Knowledge And Experience

REALTORS® possess extensive knowledge of the real estate market, including current trends, property values, and neighborhood statistics. Their expertise helps clients make informed decisions, whether setting the right price for a property or making a competitive offer. Additionally, once licensed, REALTORS® must complete 18 hours of continuing education courses every two years for license renewal. This ongoing education ensures REALTORS® stay updated on industry changes and maintain their expertise, allowing them to navigate the complexities of the market and guide clients effectively.

3. Access to Comprehensive Market Data

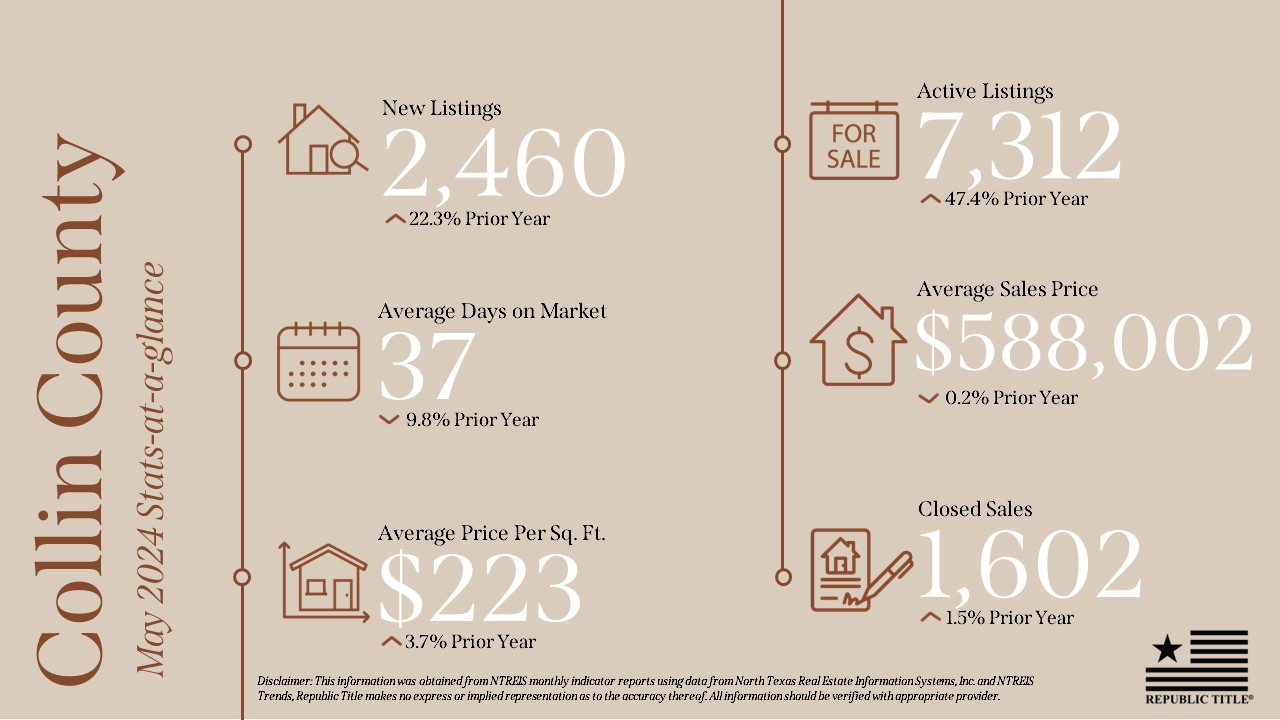

One of the significant advantages of using a REALTOR® is access to comprehensive market data and listings. Realtors have access to Multiple Listing Services (MLS), a database of available properties that provides detailed information, including property history, price changes, and comparable sales. This data is crucial for buyers to find the right property and for sellers to price their home competitively. Additionally, REALTORS® can provide insights into market conditions that are not readily available to the public.

4. Professional Networking And Connections

REALTORS® have an extensive network of professionals in the real estate industry, including mortgage brokers, home inspectors, appraisers, and attorneys. These connections can be beneficial for clients throughout the buying or selling process. For example, a REALTOR® can recommend a reputable home inspector to ensure the property is in good condition or connect buyers with a mortgage broker who can offer competitive financing options. This network of professionals helps streamline the transaction process and provides clients with trusted resources.

5. Negotiation Skills

Effective negotiation is a critical aspect of real estate transactions. REALTORS® are skilled negotiators who can advocate on behalf of their clients to achieve the best possible terms and conditions. Whether negotiating the purchase price, contingencies, or repairs, REALTORS® have the experience to handle negotiations professionally and effectively. Their goal is to protect their client’s interests and ensure a fair and favorable outcome.

6. Assistance With Paperwork And Legal Requirements

Real estate transactions involve a significant amount of paperwork and legal documentation. A REALTOR® can help clients navigate these documents, ensuring that all necessary forms are completed accurately and submitted on time. This includes purchase agreements, disclosures, inspection reports, and other legal documents. REALTORS® also stay updated on local, state, and federal regulations, ensuring compliance and minimizing the risk of legal issues.

7. Objective Guidance And Support

Emotional attachment and stress can cloud judgment during real estate transactions. REALTORS® provide objective guidance and support, helping clients make rational decisions. They offer a balanced perspective, weighing the pros and cons of each option, and providing honest feedback. This objectivity is particularly valuable in negotiations and when evaluating property conditions, ensuring clients make decisions that align with their goals and financial interests.

8. Local Market Insight

REALTORS® have in-depth knowledge of local markets, including neighborhood dynamics, school districts, amenities, and future development plans. This insight helps buyers choose the right location that meets their lifestyle and investment goals. For sellers, understanding the local market ensures accurate pricing and effective marketing strategies, attracting the right buyers and maximizing the property’s value.

9. Post-Sale Support

The relationship with a REALTOR® doesn’t end at closing. Many REALTORS® offer post-sale support, assisting with any issues that arise after the transaction is complete. This can include recommending contractors for home improvements, providing market updates, or helping with future real estate needs. This ongoing support ensures clients feel secure and supported long after the deal is closed.

Check out more REALTOR® resources like this one in the Resources section on our website here.