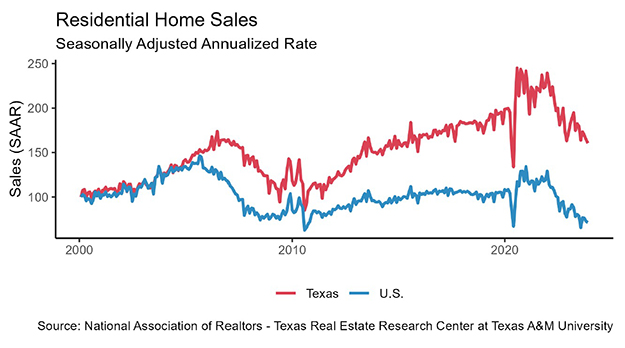

The housing market remains tight despite mortgage rates falling from their elevated levels. Home sales decreased just shy of 1 percent month over month (MOM). Prices did not fall alongside sales as most of the state experienced minimal change in prices. Construction permits plummeted in November despite construction starts increasing. Homes sat on the market for less time as average days on market continued its decreasing trend observed this year.

Home Sales Fall as Listings Increase

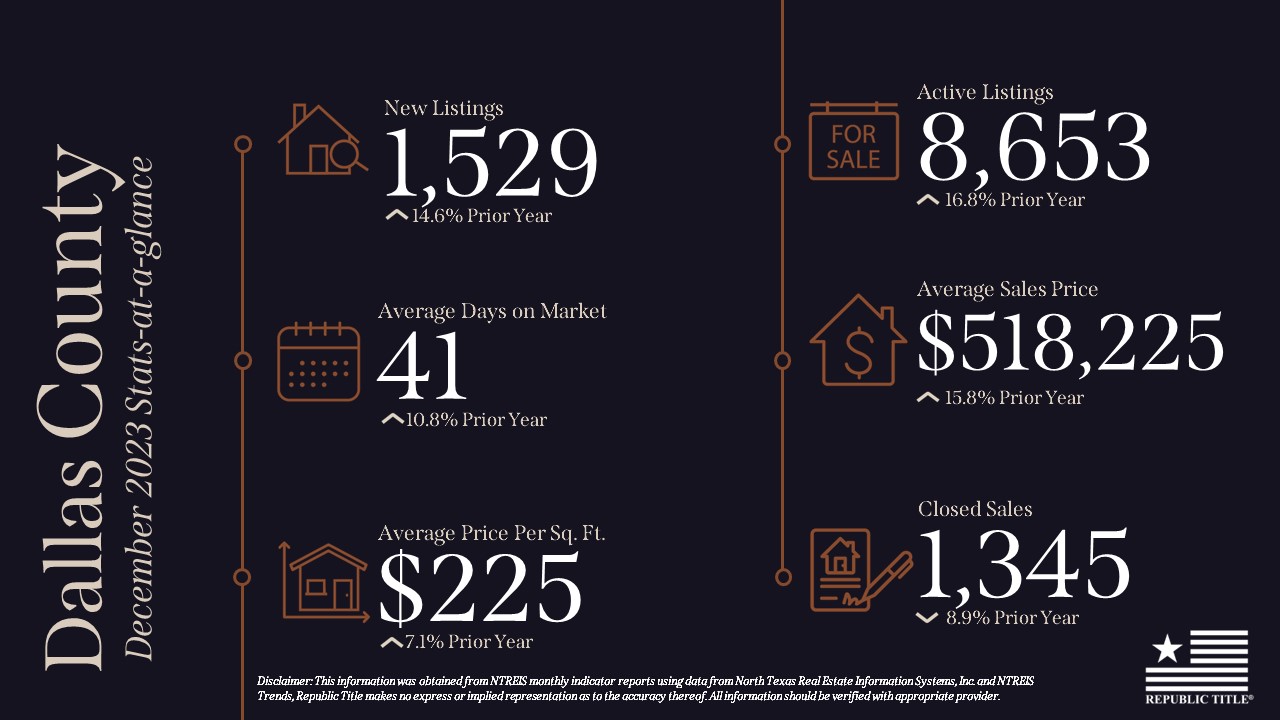

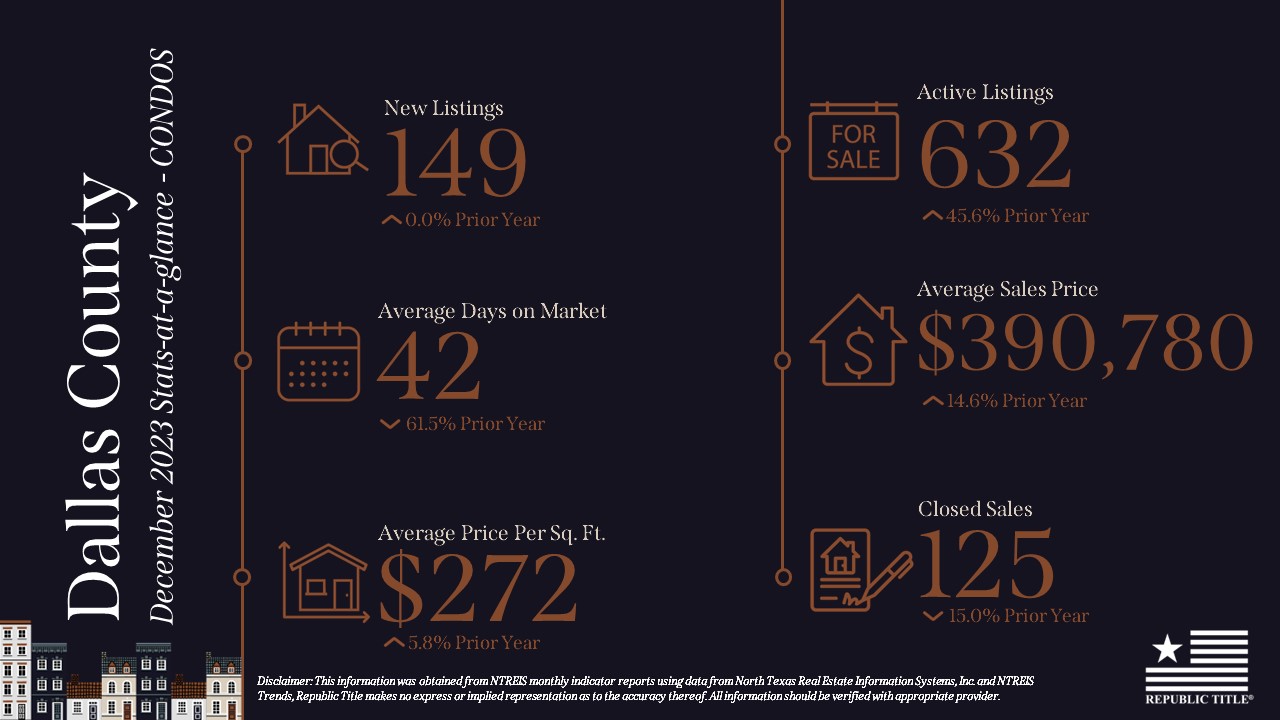

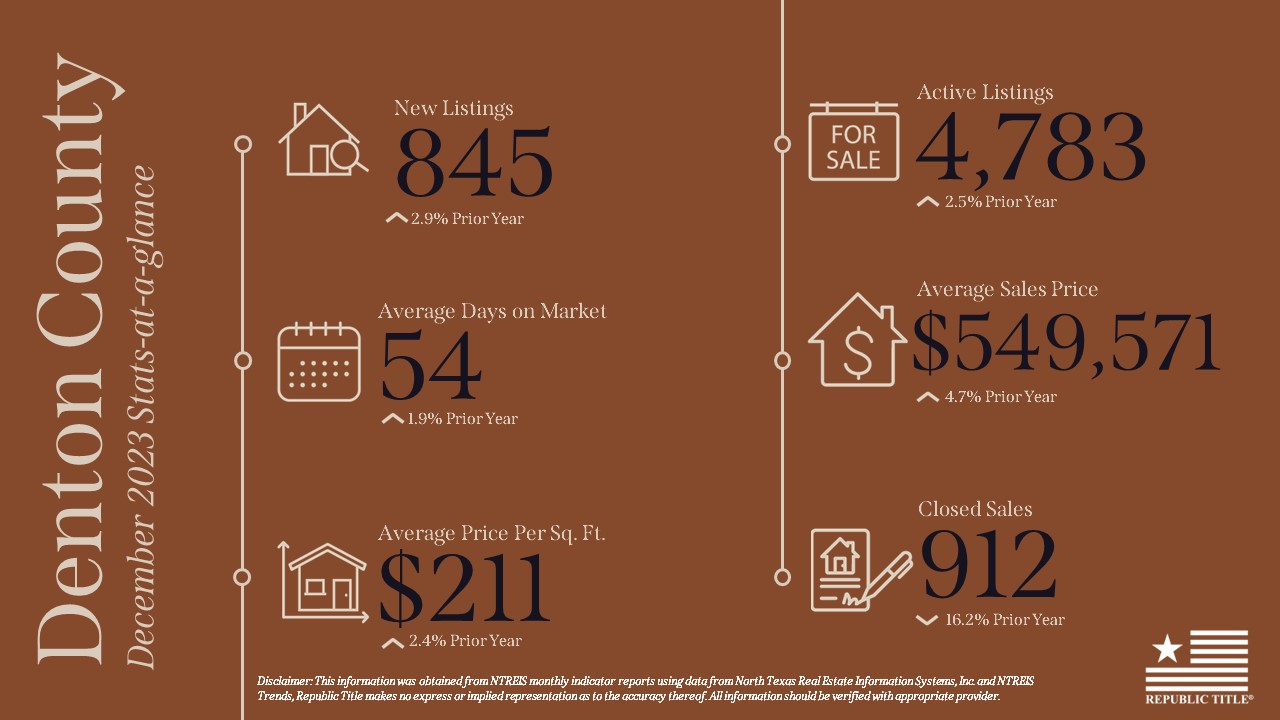

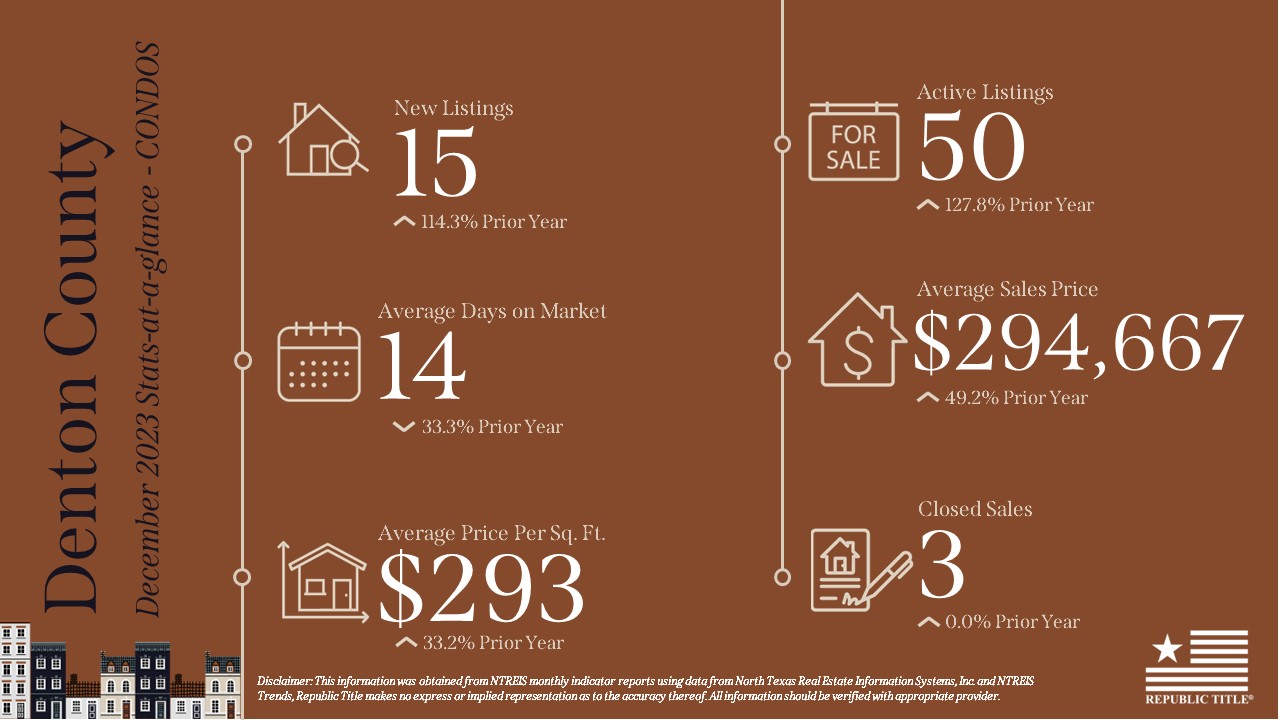

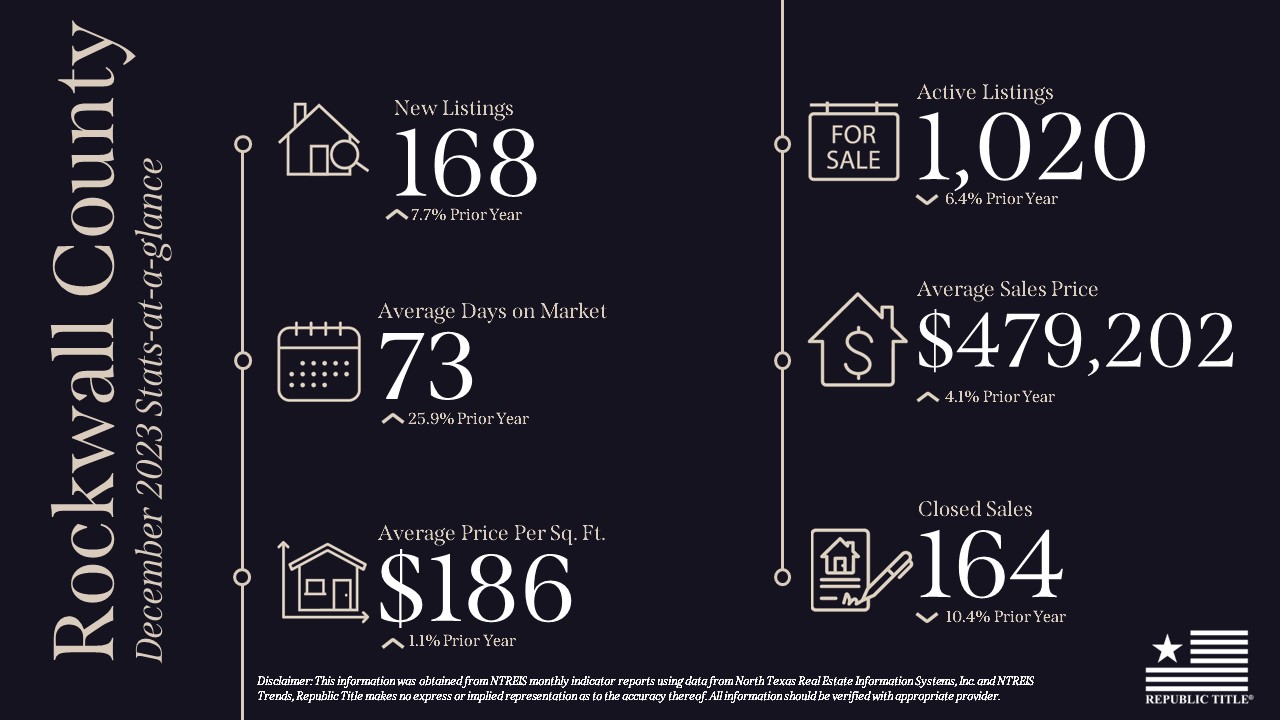

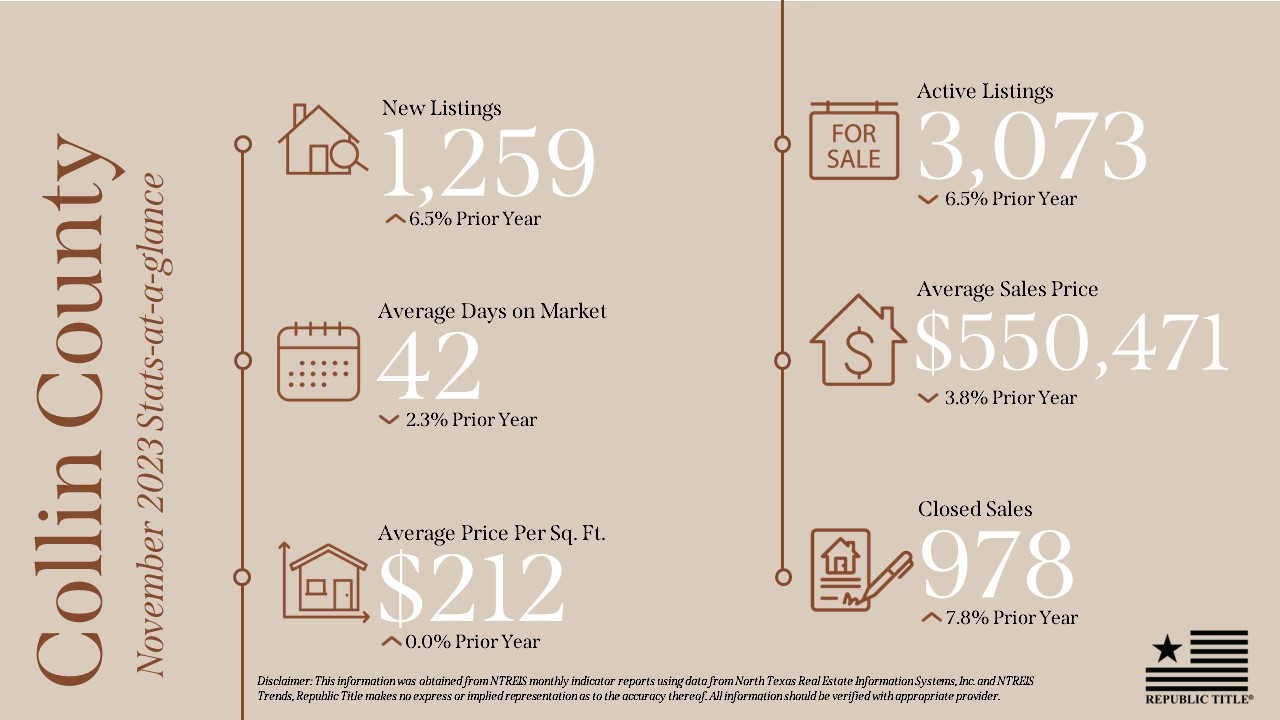

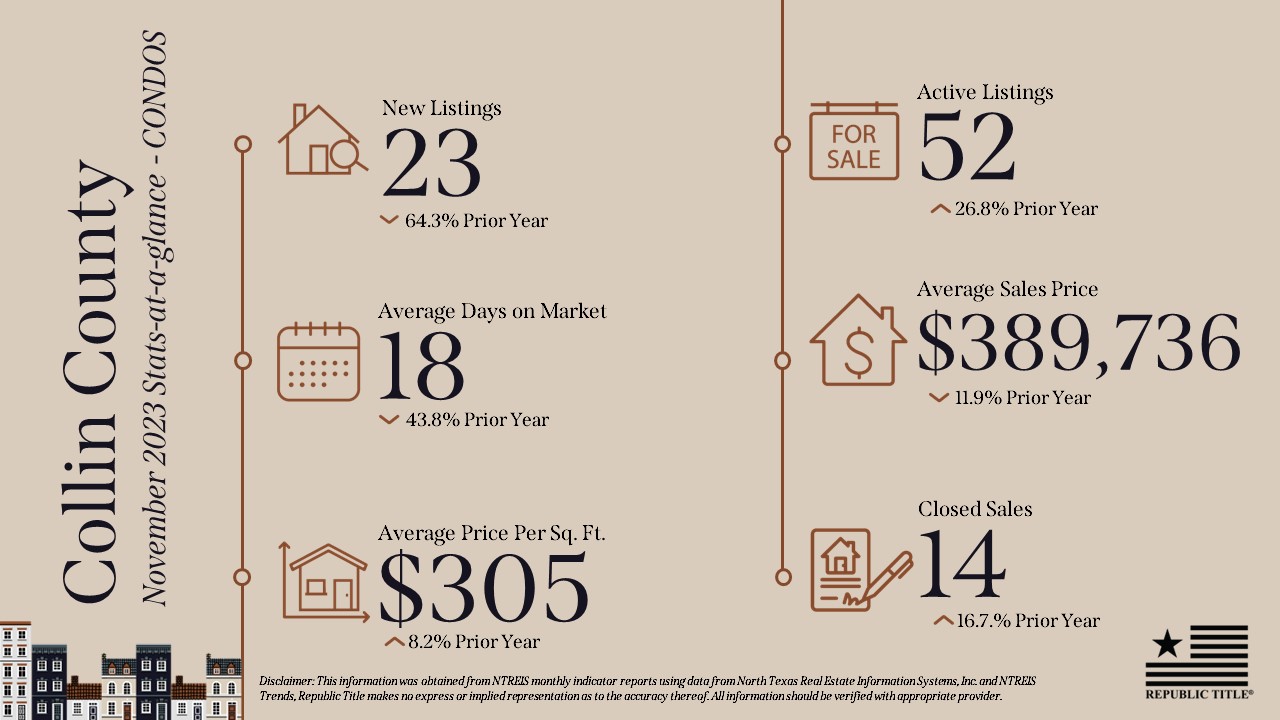

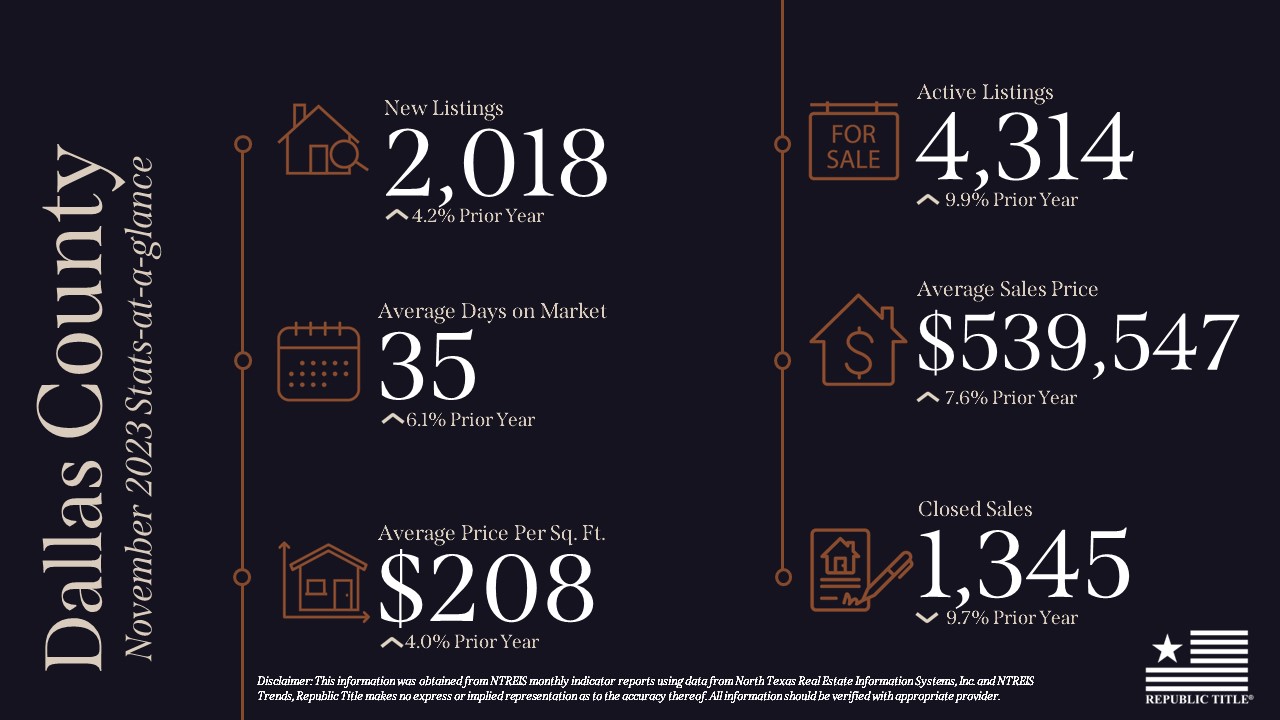

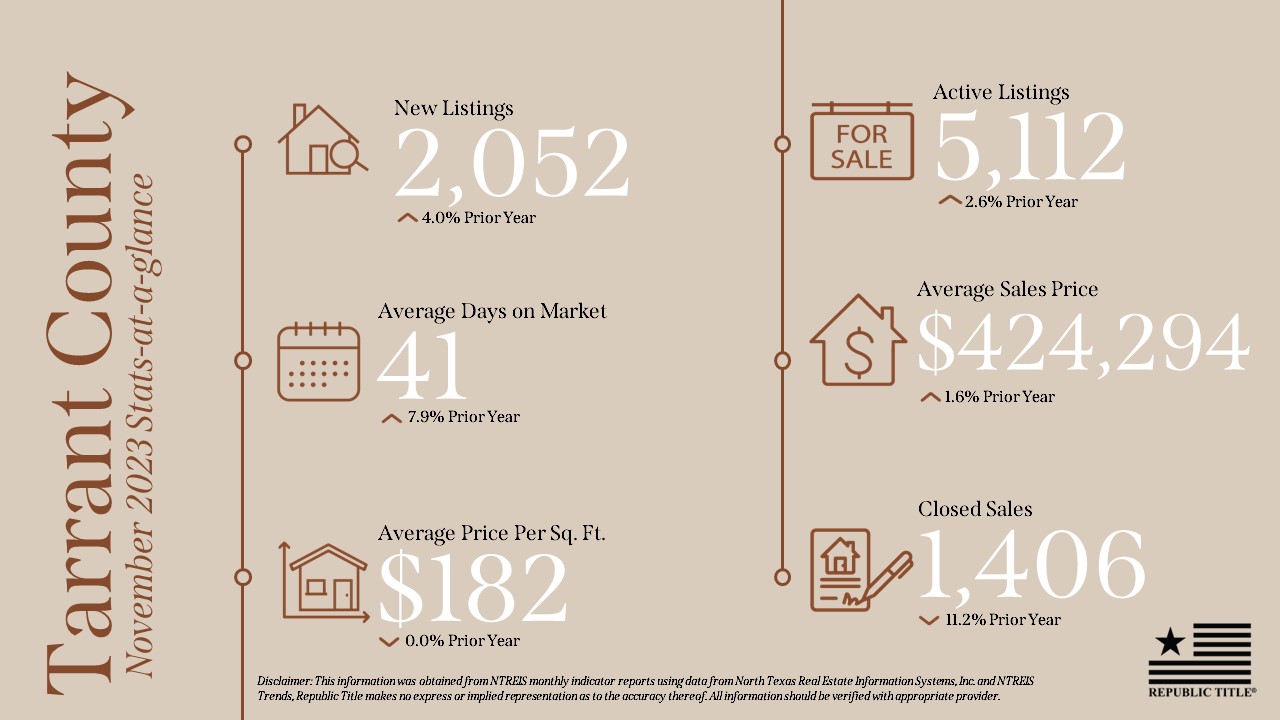

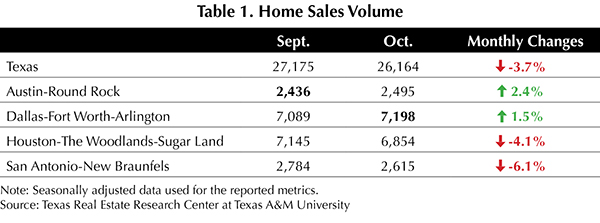

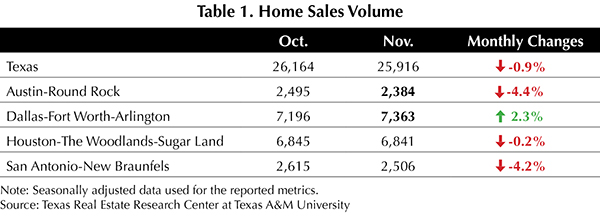

Mortgage rates fell this month, but their elevated level remains problematic for homebuyers as Texas’ total home sales fell 0.9 percent MOM to 25,916 sales in November (Table 1). Among the Big Four, Dallas reported the only increase in home sales, rising 2.3 percent to 7,363 sales. Austin fell 4.4 percent, and San Antonio reported its second straight month of significant decreases, plummeting 8.9 percent. The gap between Dallas and Houston widened as both continued to move in opposite directions. High mortgage rates have created an affordability problem, with people needing to spend more of their total income on affording a median-priced home.

The state’s average days on market (DOM) fell to 51, continuing the decline observed in 2023. For the past seven months, readings have gone from 59 to 51 days, indicating a shorter listing period. Among the major metros, Austin (75 days) and San Antonio (70 days) reported DOM significantly above the state average, while Houston (43 days) and Dallas (46 days) experienced minor fluctuations from the previous month.

Housing supplies are stocking up as active listings marked their sixth straight month of increases, climbing to 104,058 listings. This is the first time in four years supply has hit six-digit numbers. All four major metros posted monthly gains with Dallas adding 1,949 listings (9.1 percent) while Austin added fewer than a hundred homes for the third consecutive month. The constant increases since the start of 2023 have put the state’s active listings at January 2019 levels.

The state’s new listings rose 1.85 percent to 43,255 in November. San Antonio contributed heavily to this jump, rebounding from last month’s fall with a 9.4 percent increase. Dallas’s numbers remained unchanged from October. Amid the rise in active listings, the months of inventory (MOI) had a small increase to 3.7 months with all four major metros also posting small increases.

Mortgage Rates Fall from Peak Values

As news broke that the Fed might be finished with their rate hikes, treasury and mortgage rates fell. The ten-year U.S. Treasury Bond yield fell 30 basis points to 4.5 percent. Likewise, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate fell 18 basis points to 7.44 percent. The decreases across the board signal an increase in housing affordability.

Mixed Single-Family Construction Activity

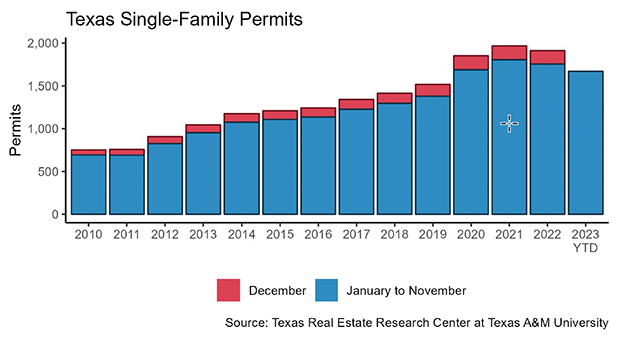

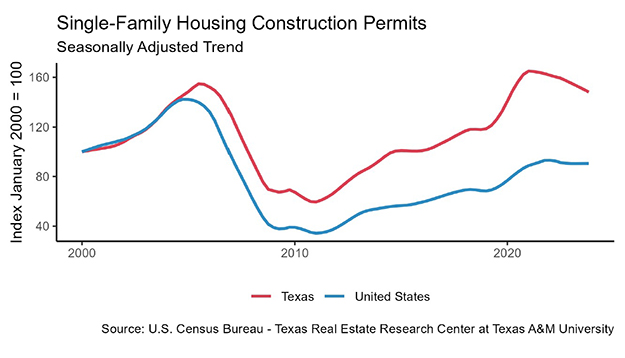

Texas’ single-family construction permits fell 1.7 percent MOM to 12,418 issuances. Both Austin and San Antonio had MOM dips falling 7 percent and 16 percent, respectively. Houston was essentially unchanged with only a 0.3 percent decline while Dallas grew by 1.3 percent.

Construction starts grew while construction permits fell, according to data from Dodge Construction Network. Single-family starts increased 1.1 percent MOM to 11,744 units. Both Dallas (3,393 starts) and Houston (3,510 starts) continued to outperform the rest of the state, combining for 58 percent of the total starts. Austin increased its lead over San Antonio, with 1,647 starts approaching a 3:1 ratio compared to San Antonio. Historically, Austin’s advantage has been about 2:1 in total starts.

The state’s year-to-date total single-family starts value climbed to $27.7 billion, up from $25.4 billion in October. Starts values have been mirroring 2019 values since May, remaining within $1 billion dollars from the observed 2019 values. Houston and Dallas both accounted for 30 percent of the state’s construction activity values.

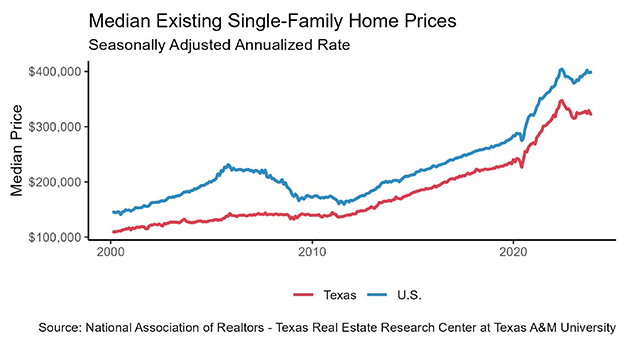

Median Home Price Steady Across the Big Four

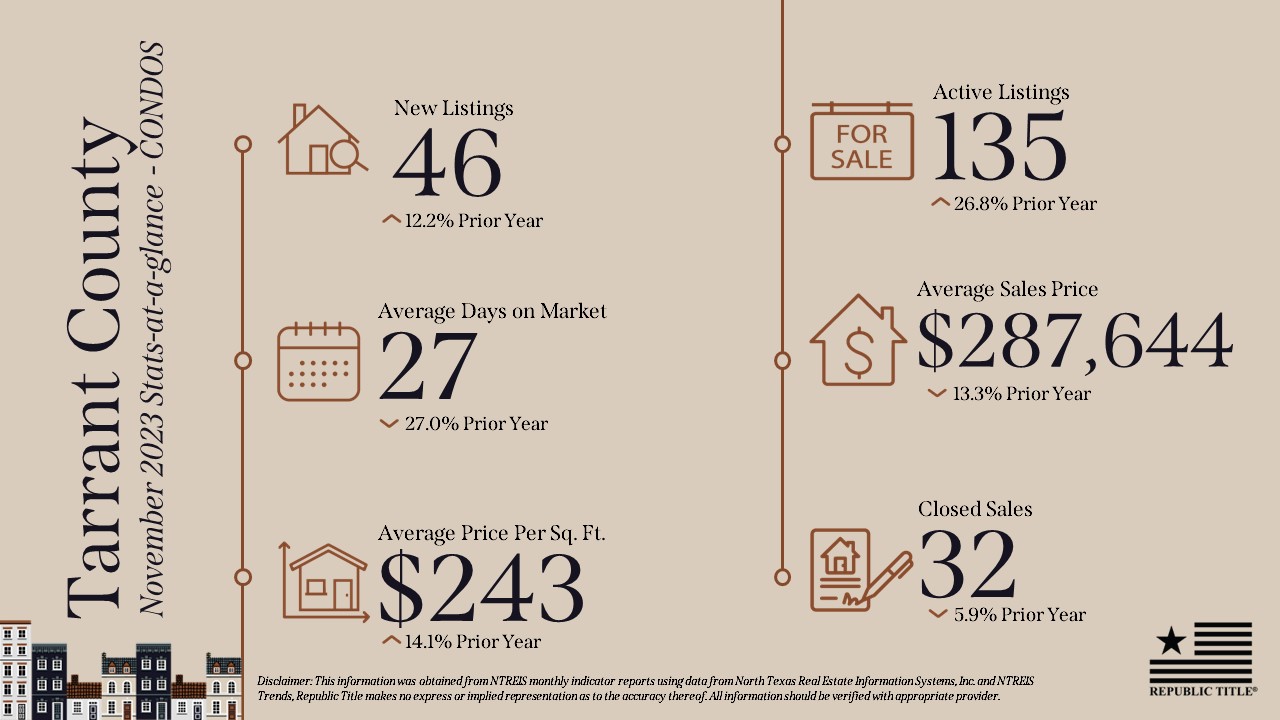

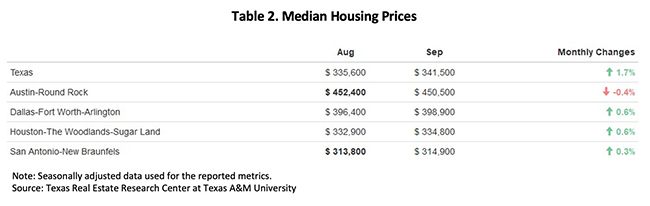

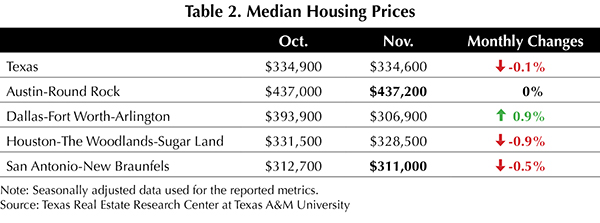

Texas’ median home prices recorded a modest decline, falling 0.1 percent to $334,600 (Table 2). All of the Big Four recorded marginal changes of less than 1 percent, with Dallas exhibiting the only increase in price at 0.9 percent. Austin’s home prices have come down significantly from the highly inflated 2022 prices, although remain elevated from pre-COVID prices.

Home prices continued to hover around $200,000-$300,000 and $300,000-$400,000, accounting for 26 and 24 percent of total home sales, respectively.

The Texas Repeat Sales Home Price Index (Dec 2004=100) fell 0.9 percent MOM but remains 2 percent up from the previous year. Houston had the highest annual appreciation at 2.6 percent YOY increase while Austin showed the lowest annual appreciation at negative 3 percent.

Source – Joshua Roberson and Koby McMeans (January 24, 2024)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight