When navigating the complexities of real estate transactions, particularly in Texas, one of the critical decisions involves choosing the title company. A title company plays a pivotal role in ensuring that the transfer of property ownership is smooth, legal, and secure. But who exactly has the authority to pick the title company in Texas? Understanding this process is essential for buyers, sellers, and real estate professionals alike.

The Role of the Title Company

Before delving into who selects the title company, it’s important to understand what a title company does. A title company is responsible for verifying the legal ownership of a property, ensuring there are no liens or encumbrances, and facilitating the transfer of ownership from seller to buyer. In addition, the title company provides title insurance, which protects the buyer and lender against potential liens or disputes over ownership that may arise after the sale is completed.

Title insurance is vital in real estate transactions as it ensures that the buyer receives a clear and marketable title, free from any legal claims that could jeopardize their ownership. Given the importance of this role, selecting a reputable title company is crucial.

Who Chooses the Title Company?

In Texas, the selection of the title company is not set by law, but rather it is often determined by negotiation between the buyer and seller. This decision is typically outlined in the real estate contract during the negotiation process. Here’s how it usually breaks down:

- Seller’s Preference: In many cases, especially in a seller’s market, the seller may prefer to

choose the title company. Sellers often have a title company they’ve worked with before or one

that is familiar with the property often making the process smoother and more efficient. - Buyer’s Input: In a buyer’s market or in situations where the buyer has specific preferences,

the buyer may negotiate to select the title company. Some buyers may prefer a title company

they’ve worked with in the past or one that is highly recommended by their real estate agent or

lender. - Mutual Agreement: Often, the buyer and seller come to a mutual agreement on which title

company to use. This agreement is usually based on recommendations from real estate agents,

past experiences, or the reputation of the title company. - Lender’s Role: In some cases, the lender may have a preferred title company, particularly if the

lender is providing financing for the purchase. While the lender cannot force the buyer or seller

to use a specific title company, they may recommend one, and their input can influence the

decision.

Factors to Consider When Choosing a Title Company

Whether you’re a buyer, seller, or real estate professional, selecting the right title company is a significant decision. Here are some factors to consider:

- Financial Strength: One critical aspect often overlooked when choosing a title company is its

financial strength. A financially robust title company is better positioned to pay out claims should

an issue arise after the sale is completed. Title insurance is only as reliable as the company

backing it; therefore, choosing a title company with a strong financial standing ensures that they

can fulfill their obligations, offering peace of mind to all parties involved. - Reputation: The reputation of the title company is paramount. A company with a strong track

record, positive reviews, and a history of successful transactions is likely to provide a smoother

experience. - Experience: The complexity of real estate transactions requires a title company with extensive

experience. Look for a company that has been in business for several years and has handled a

variety of transactions. - Customer Service: Exceptional customer service is crucial in real estate transactions, which

can be stressful and time-sensitive. A title company that is responsive, communicative, and

willing to go the extra mile can make a significant difference. - Local Knowledge: A title company with deep knowledge of the local real estate market and

laws can provide invaluable insight and guidance throughout the transaction process.

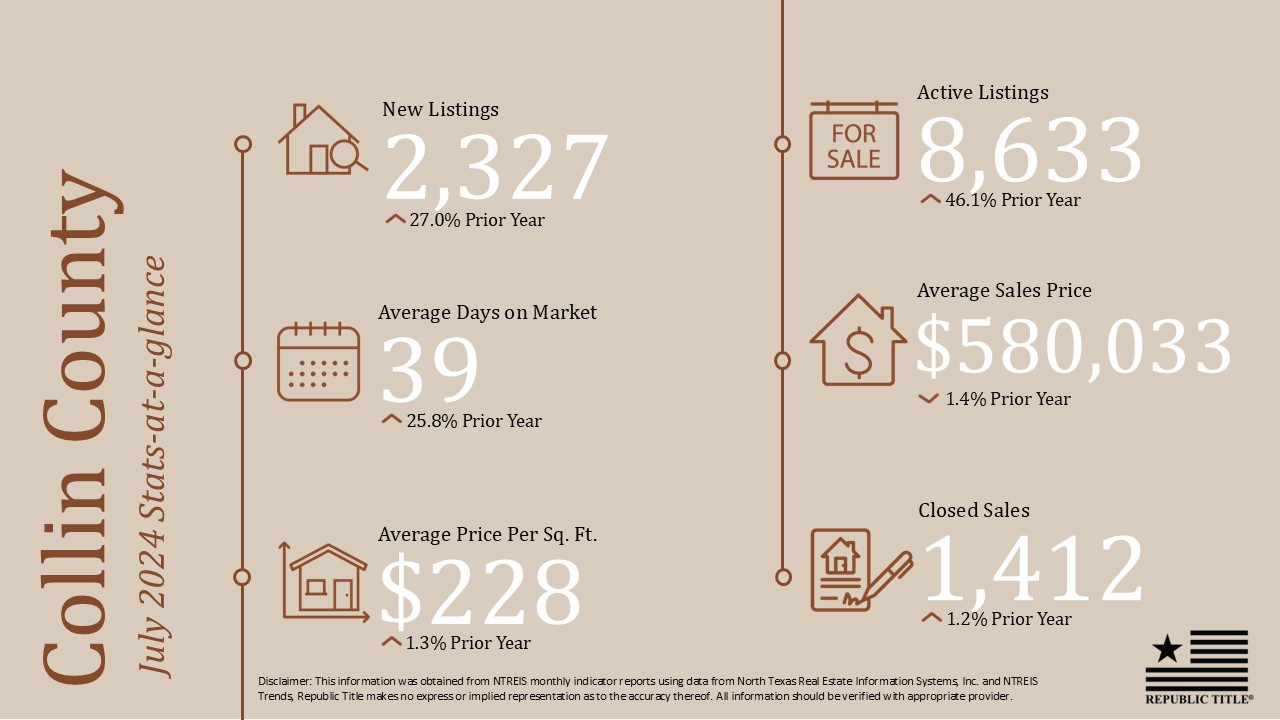

Why Republic Title Is the Preferred Partner in North Texas

When it comes to choosing a title company in Texas, Republic Title stands out as the preferred partner for many buyers, sellers, and real estate professionals. As a full-service title insurance company, Republic Title handles the transfer of title for real estate transactions with the utmost care, professionalism, and integrity. Their mission is to provide value to every customer through proven experience, dedicated service, and lasting relationships.

Republic Title’s commitment to exceptional, responsive customer service is unsurpassed. With a track record of success and a reputation built on trust, Republic Title ensures that every real estate transaction is handled with the highest level of expertise. Moreover, Republic Title’s strong financial foundation guarantees their ability to pay claims, providing additional security to their customers. Their deep understanding of the North Texas market, combined with their extensive experience in handling both residential and commercial transactions, makes them the go-to choice for title services in the region.

Source: Republic Title Tip: Who Picks the Title Company in Texas? – CandysDirt.com