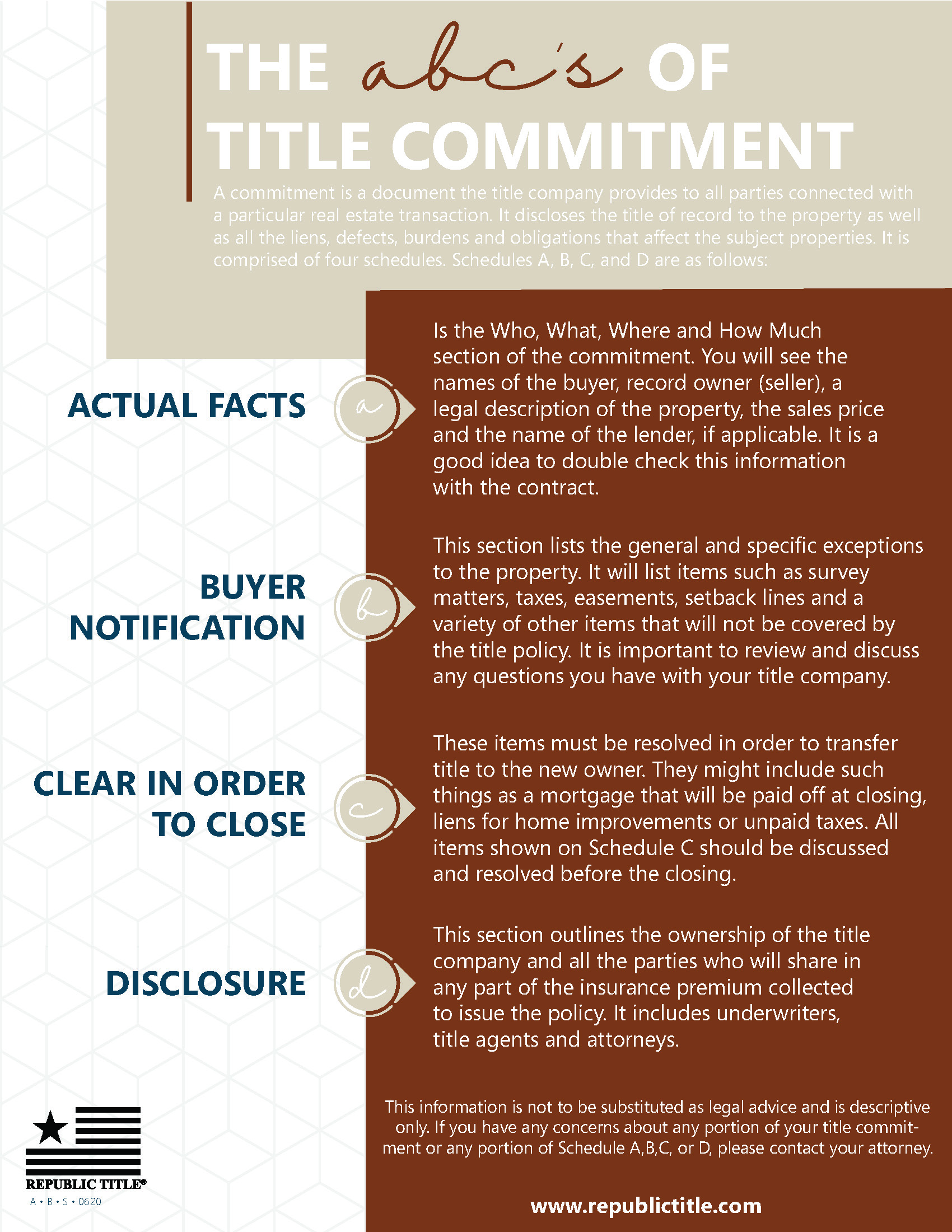

A commitment is a document the title company provides to all parties connected with a particular real estate transaction. It discloses the title of record to the property as well as all the liens, defects, burdens and obligations that affect the subject properties. It is comprised of four schedules. Schedules A, B, C, and D are as follows:

A – Actual Facts – Is the Who, What, Where and How Much section of the commitment. You will see the names of the buyer, record owner (seller), a legal description of the property, the sales price and the name of the lender, if applicable. It is a good idea to double check this information with the contract.

B- Buyer Notification – This section lists the general and specific exceptions to the property. It will list items such as survey matters, taxes, easements, setback lines and a variety of other items that will not be covered by the title policy. It is important to review and discuss any questions you have with your title company.

C- Clear In Order To Close – These items must be resolved in order to transfer title to the new owner. They might include such things as a mortgage that will be paid off at closing, liens for home improvements or unpaid taxes. All items shown on Schedule C should be discussed and resolved before the closing.

D – Disclosure – This section outlines the ownership of the title company and all the parties who will share in any part of the insurance premium collected to issue the policy. It includes underwriters, title agents and attorneys.

This information is not to be substituted as legal advice and is descriptive only. If you have any concerns about any portion of your title commitment or any portion of Schedule A,B,C, or D, please contact your attorney.