Despite mortgage rates continuing to fall from their elevated level, housing sales haven’t rebounded. The average price has fallen alongside home sales, with homes costing $2,000 less than in November. Single-family starts increased while permits moved downward. Homes sat on the market for longer in December as average days on market reported its first increase since the beginning of the year.

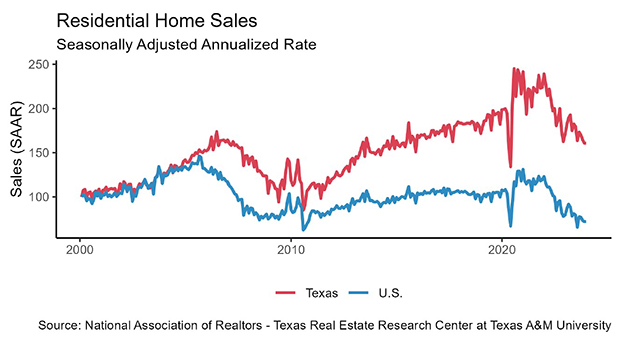

Home Sales Fall Alongside Listings

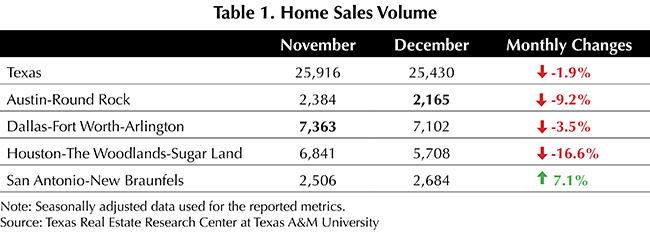

Mortgage rates continued to fall, but their elevated level remains problematic for homebuyers as Texas’ total home sales fell 1.9 percent month over month (MOM) to 25,430 (Table 1). Among the Big Four, San Antonio reported the only gain in home sales, jumping 7.1 percent to 2,684. Houston’s home sales decreased by 16.6 percent, losing over 1,000 sales in December. Austin and Dallas also experienced losses, falling by 9.2 percent and 3.5 percent, respectively. The gap between Houston and Dallas widened as Houston reported poor monthly sales. Despite rates falling, they remain elevated, resulting in an affordability problem for homebuyers.

The state’s average days on market (DOM) climbed to 57, marking the first increase since April. This increase suggests longer listing times could be approaching. All four of the major metros experienced increases in DOM with Houston (50 days) and Dallas (49 days) rising by seven and four days, respectively. Austin (77 days) and San Antonio (68 days) had minor fluctuations from the previous month.

Housing supplies remained elevated, but active listings fell for the first time since May, falling to 103,395 listings. San Antonio (12,254) was the only one of the Big Four to post a monthly increase at 1 percent. Austin had the largest drop in active listings with a 13.3 percent loss to 8,307 listings. Dallas (22,056) and Houston (24,770) had moderate reductions. Despite the fall in active listings in December, levels are still on pace with 2019.

The state’s new listings fell 1.89percent to 42,658 in December. All four of the major metros posted monthly decreases of between 2 and 4 percent. Austin had a 2 percent decrease to 3,766 listings while San Antonio had the largest decrease at 4 percent. Amid the fall in active listings, the months of inventory (MOI) experienced a small decrease to 3.6 with Austin contributing heavily to the fall, dropping over 10 percent.

Mortgage Rates Continue to Plunge

Treasury and mortgage rates continued to fall amidst rumors of interest rate hikes being finished. The ten-year U.S. Treasury Bond yield fell 48 basis points to 4.02 percent. Likewise, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate fell 62 basis points to 6.82 percent. If rates continue to fall into the start of 2024, housing affordability should improve.

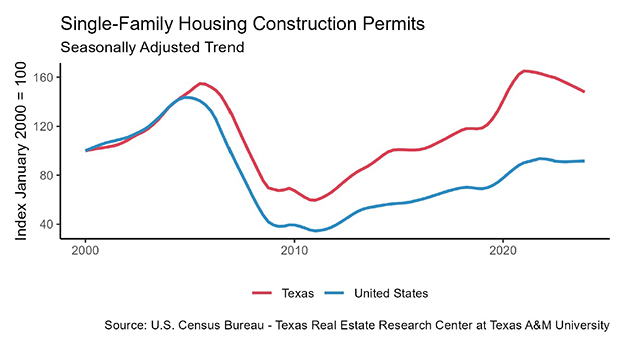

Permits Unchanged, Starts on the Rise

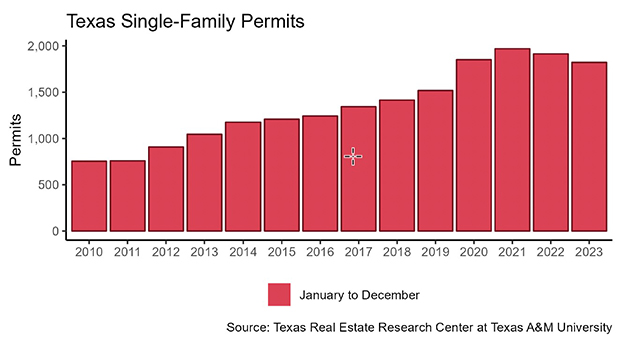

Texas’ single-family construction permits moderated just shy of a quarter of a percent decrease from November, falling to 12,392 issuances. Dallas and San Antonio had monthly dips falling 5.3 percent and 12.9 percent, respectively. Houston and Austin both experienced minor fluctuations of less than ten issuances.

Construction starts grew while construction permits remained effectively unchanged, according to data from Dodge Construction Network. Single-family starts increased 2.5 percent MOM to 12,222 units. Despite the Texas increase, San Antonio (8,08 starts) reported the only monthly increase among the Big Four, rising 20.6 percent. Austin (1,392 starts) fell 13.6 percent, making the ratio of Austin to San Antonio starts fall under the typical 2:1 ratio. Dallas (3,250 starts) and Houston (3,448 starts) continued to outperform the rest of the state, combining for 55 percent of total starts.

The state’s year-to-date total single-family starts value climbed to $29.8 billion, up from $27.7 billion in November. Starts values continued to mirror 2019 values since May, however, value fell just outside the $1 billion dollar threshold in December. Houston and Dallas accounted for over 60 percent of the state’s construction value.

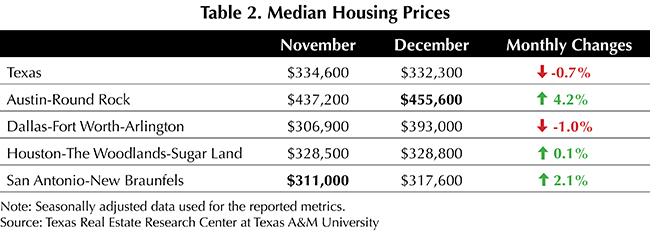

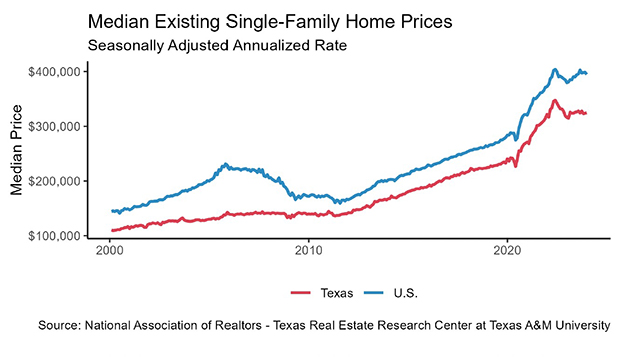

Median Home Prices Fall Despite Big Four Rising

Texas’ median home price fell 0.7 percent to $332,300 (Table 2). Among the Big Four metro areas, Dallas posted the only decrease, falling by 1 percent. Austin saw the greatest price boost with a 4.2 percent gain, raising the price to its highest level since January. Home prices across the Big Four remain above pre-COVID prices.

Home prices continued to hover around $200,000-$300,000 and $300,000-$400,000, accounting for 26 and 24 percent of total home sales, respectively.

The Texas Repeat Sales Home Price Index (Dec 2004=100) fell 0.9 percent MOM but remains 2 percent up from the previous year. Houston had the highest annual appreciation at 2.6 percent YOY increase while Austin showed the lowest annual appreciation at negative 3 percent.

Source – Joshua Roberson and Koby McMeans (February 20, 2024)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight