Total Texas housing sales stabilized in November following record-setting levels the previous month. Building permits and housing starts normalized after months of strong activity. On the other hand, average days on market fell to just 44 days, indicating steady demand as mortgage interest rates reached all-time lows. Depleted inventory contributed to double-digit annual growth in the median home sales price as an extreme shortage of homes priced less than $300,000 pushed buyers toward higher-priced homes. The Texas Real Estate Research Center’s Repeat Sales Home Price Index also accelerated, revealing threats to recent improvements in affordability.

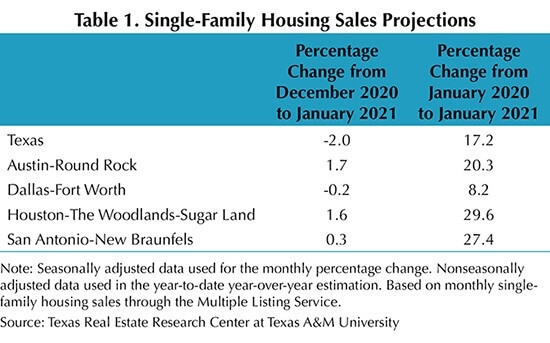

Nevertheless, Texas single-family sales are expected to maintain a rapid clip in 2021 with an 8.4 percent projected increase, assuming mortgage rates remain relatively low, and the economic reopening continues as vaccines are widely distributed (Table 1). Home sales would be even stronger if not for persistently low inventories. Robust construction activity should provide much-needed injections into the supply of active listings, but home-price growth should still be positive due to solid demand and limited inventory. The pandemic and the associated economic uncertainty remain the greatest headwinds to the Texas housing market in the new year. (For additional commentary, see the 2021 Texas Housing & Economic Outlook.)

Supply1

The Texas Residential Construction Cycle (Coincident) Index, which measures current construction levels, ticked down as real wages and industry employment slowed. Hiring in residential construction, however, has generally been positive since the initial decline in March and April. The Residential Construction Leading Index decreased due to a fall in building permits and housing starts, normalizing after strong growth in the months when the economy first reopened. The real interest rate for the ten-year Treasury bill increased, which also weighed on future improvements. On the other hand, the metropolitan leading indexes trended upward in all but North Texas, where the same statewide factors contributed to a downward adjustment in the metric.

Single-family construction permits flattened around a record-high in November after six straight monthly increases. Nevertheless, the state exceeded its 2007 average in per capita terms. Dallas-Fort Worth topped the national list, issuing 3,641 nonseasonally adjusted permits. Houston followed with 3,630 permits but posted a third consecutive seasonally adjusted decline. Nonetheless, the trend remained on a strong upward trajectory. In Central Texas, 1,974 and 870 permits were issued in Austin and San Antonio, respectively. Texas’ multifamily permits improved on a monthly basis; the year-to-date (YTD) sum, however, fell 8.3 percent compared with the same period last year as demand for single-family homes during the pandemic shifted focus away from the apartment sector.

Although total Texas housing starts decreased 9.5 percent, activity was still on pace to surpass last year’s groundbreakings by about 10 percent. Moreover, the Department of Commerce lowered lumber tariffs from 20 to 9 percent in December, which should help reduce homebuilder costs moving forward. Single-family private construction values mirrored starts as the metric declined 12.8 percent but continued to trend upward. Reduced values in North Texas and Houston accounted for half of the overall drop while Austin and San Antonio recorded more modest contractions.

Although sales activity decelerated, the number of new homes hitting the market flattened for the second straight month after a five-month recovery from pandemic-related declines in March and April. Texas’ months of inventory (MOI) fell to an all-time low of two months. A total MOI of around six months is considered a balanced housing market. Inventory for homes priced less than $300,000 was even more constrained, sliding to just 1.5 months. Even the MOI for luxury homes (homes priced more than $500,000) fell below 4.8 months compared with 7.6 months a year ago.

In Central Texas, listings continued to fly off the market at a rapid pace, chipping away at inventory. The MOI sank to 0.9 months in Austin and matched the statewide average in San Antonio. Dallas’ and Fort Worth’s metrics fell to 1.5 and 1.4 months, respectively. The Houston MOI decreased at a slower rate, hovering at 2.4 months as the metro’s supply of active listings expanded for the second straight month due to new listings in the $300,000-$400,000 and luxury home price ranges.

Demand

Total housing sales were flat in November, ticking down 0.7 percent after reaching record levels the previous month. The modest decline was concentrated in activity for homes priced less than $300,000 as severely limited inventory weighed on sales. Nevertheless, the overall trend remained on a steep upward trajectory with cumulative sales this year exceeding last year’s 11-month sum by 9.0 percent compared with 6.4 percent nationwide. The current rate of growth, however, is likely unsustainable despite stable demand given the state’s depleted inventory.

North Texas and Houston accounted for most of the state’s monthly downtick. Sales declined 2.9 percent in Dallas and 2.3 and 1.2 percent in Fort Worth and Houston, respectively, as decreased transactions at the lower end of the price spectrum offset increases for higher-priced homes. On the other hand, San Antonio posted a record-breaking 3,888 sales after 2.2 percent monthly growth. Austin sales also reached an all-time high, exceeding 4,000 transactions. A list-to-sale-price ratio greater than 1.0 corroborated strong activity in the metro.

Record low mortgage interest rates and shifting homebuyer preferences toward additional living space in residences contributed to robust demand. Texas’ average days on market (DOM) dropped to an all-time low of 44 days, shedding more than two weeks off its year-ago reading. Homes flew off the shelves even faster in the major metros, remaining on the market for only 32 days in Austin and 33 days in Fort Worth. Dallas averaged a DOM of 35 days, while Houston’s metric slid to 43 days. San Antonio’s DOM ticked down to 49 days but persisted above the state average.

Expansionary monetary measures by the Federal Reserve and positive news regarding the coronavirus vaccines lessened investors’ urges to buy safe haven assets. The ten-year U.S. Treasury bond yield inched up for the fourth straight month to 0.9 percent2. Still, a resurgence in COVID-19 cases and persistent uncertainty surrounding the pandemic kept interest rates hovering at historically low levels. The Federal Home Loan Mortgage Corporation’s 30-year fixed-rate fell to an unprecedented reading below 2.8 percent (series starting in 1971). Mortgage rates hovered around decades-low levels within Texas during October, sinking to 2.89 percent for non-GSE loans, while the median interest rate for GSE loans was 2.95 percent. Although home-purchase applications stabilized in November, the steady drop in rates pushed activity up 16.7 percent YTD. Refinance applications nearly doubled since year-end after tripling in 2019, but the pace is expected to decelerate as the lenders add more requisites and the pool of households able to refinance shrinks. (For more information, see Finding a Representative Interest Rate for the Typical Texas Mortgagee.)

In October, the median loan-to-value ratio (LTV) and debt-to-income ratio (DTI) constituting the “typical” Texas conventional-loan mortgage decreased from 87.5 to 84.2 and 37.3 to 35.3, respectively. The median credit score increased from 739 to 752, exceeding levels during the initial rise in average consumer credit scores, which rose due to early relief actions taken by the federal government and lenders that helped some households pay off debt and save money. The median LTV of the typical Texas borrower who obtained a loan from a GSE ticked up slightly from 85.0 to 85.3 but continued to trend downward, while the median DTI slipped from 35.6 to 35.2. The overall trend of improved credit profiles may reflect tightening lending standards as economic uncertainty prevails.

Prices

The Texas median home price accelerated 12.7 percent year over year (YOY) in November to a record-high $274,800. A shift in the composition of sales toward higher-priced homes due to constrained inventories at the lower end of the price spectrum contributed to the increase in prices. Double-digit annual price growth in the state’s metropolitan areas pushed median home prices to all-time highs as well. Austin’s metric skyrocketed 19.7 percent YOY to $370,800, while the median price jumped 13.2 percent in San Antonio to exceed $260,200. Houston median price ($273,200) hovered near the state average after climbing 11.5 percent. In North Texas, 11.9 percent home-price appreciation pulled the metric up to $328,200 and $278,600 in Dallas and Fort Worth, respectively.

The Texas Repeat Sales Home Price Index accounts for compositional price effects and provides a better measure of changes in single-family home values. The index corroborated increased home-price appreciation amid robust housing activity, rising 7.8 percent annually, but the rate of growth was still less than the surge in the median home price suggested. The pace of San Antonio’s index moderated to 6.8 percent YOY growth, contrary to the acceleration in the metro’s median home price. The metrics in Houston and North Texas picked up speed but still registered below the state average, climbing 6.1 percent in Houston and 7.3 and 7.2 percent in Dallas and Fort Worth, respectively. On the other hand, Austin’s index soared 13.9 percent YOY. Home-price appreciation unmatched by income growth chips away at housing affordability, even as mortgage rates reach new lows.

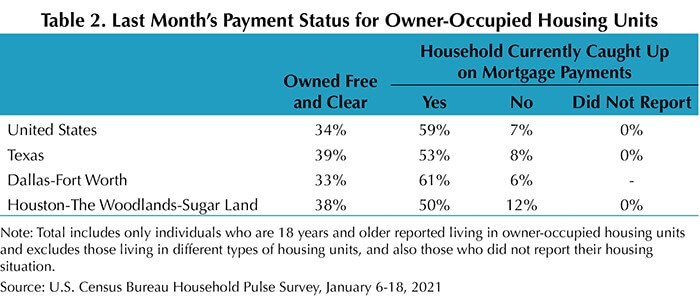

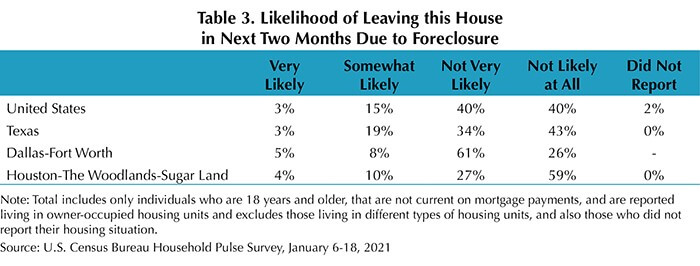

Household Pulse Survey

According to the U.S. Census Bureau’s Household Pulse Survey, 10 percent of Texas homeowners were behind on their mortgage payments during November, greater than the national share of 8 percent (Table 2). Both geographies registered an increase in the proportion of households delinquent on their mortgage payments from the previous month; this was also true of the Houston metropolitan area, where 15 percent of households were not caught up on their mortgages. In contrast, the metric fell from 12 to 8 percent in DFW. Twenty-six percent of the respondents in Texas who were not current expected foreclosure to be either very likely or somewhat likely in the next two months compared with just 19 percent nationwide (Table 3). Moreover, the percentage of Texas households who reported foreclosure to be very likely in the next two months shot up from 1 to 12 percent in November. Those delinquent in Dallas and Houston were overall less at risk of foreclosure than the state average. Just before the survey was taken, the Federal Housing Finance Agency extended the foreclosure and REO eviction moratoriums for properties owned by Fannie Mae and Freddie Mac (the Enterprises) until Jan. 31, 2021. Since the conclusion of the survey period, the Center for Disease Control and Prevention’s federal eviction moratorium has also been renewed through Jan. 31, 2021. Continued stability in the housing market is essential to Texas’ economic recovery.

________________

1 All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.

2 Bond and mortgage interest rates are nonseasonally adjusted. Loan-to-value ratios, debt-to-income ratios, and the credit score component are also nonseasonally adjusted. Texas data typically lags the Texas Housing Insight by one month.

Source – James P. Gaines, Luis B. Torres, Wesley Miller, Paige Silva, and Griffin Carter (January 13, 2021)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight